Lightning Network White Paper (繁中)

比特幣閃電網路:可擴展的 off-chain 即時支付 The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments

Joseph Poon [email protected]

Thaddeus Dryja [email protected]

二零一五年十一月二十日 草案版本 0.5.9.1

摘要 Abstract

The bitcoin protocol can encompass the global financial transaction volume in all electronic payment systems today, without a single custodial third party holding funds or requiring participants to have anything more than a computer using a broadband connection. A decentralized system is proposed whereby transactions are sent over a network of micropayment channels (a.k.a. payment channels or transaction channels) whose transfer of value occurs off-blockchain. If Bitcoin transactions can be signed with a new sighash type that addresses malleability, these transfers may occur between untrusted parties along the transfer route by contracts which, in the event of uncooperative or hostile participants, are enforceable via broadcast over the bitcoin blockchain in the event of uncooperative or hostile participants, through a series of decrementing timelocks.

如今比特幣協議可以涵蓋全球金融所有的電子支付系統的交易量,沒有單一的一個協力廠商保管或持有資金,或要求參加者除了有使用寬頻連線的電腦之外其他的什麼東西。分散式系統表明交易是被發送到一個小額支付的通道網路(又名支付通道和交易通道),其價值轉移發生在 off-blockchain 的情況下。如果比特幣的交易可以在一種新的強調延展性的類型條件下簽署,這些轉移可以在不受信任的雙方之間通過合約沿著傳送路徑進行,在一系列遞減時間鎖鏈中,如果有非合作或敵對的參與者,則採取在比特幣區塊鏈上強制執行的辦法。

1 比特幣區塊鏈可擴展性問題 The Bitcoin Blockchain Scalability Problem

The Bitcoin1 blockchain holds great promise for distributed ledgers, but the blockchain as a payment platform, by itself, cannot cover the world’s commerce anytime in the near future. The blockchain is a gossip protocol whereby all state modifications to the ledger are broadcast to all participants. It is through this “gossip protocol” that consensus of the state, everyone’s balances, is agreed upon. If each node in the bitcoin network must know about every single transaction that occurs globally, that may create a significant drag on the ability of the network to encompass all global financial transactions. It would instead be desirable to encompass all transactions in a way that doesn’t sacrifice the decentralization and security that the network provides.

比特幣1區塊鏈在擁有分散式分類帳方面很有前景,但在不久將來的某個時間,會出現區塊鏈作為一個支付平臺,其本身不能覆蓋全球的電子商務的情況。區塊鏈是一個八卦協議,把所有國家向總帳發的更改發佈給所有的參與者。國家的共識,每個人的餘額通過這種“八卦協定”達成一致。如果在比特幣網路中的每個節點必須瞭解在全球範圍發生的每一個交易,可能造成阻礙網路涵蓋全球所有金融交易的能力。相反,若能涵蓋全球所有金融交易,並且不會使分散化和安全性受到損害,這才是我們需要的。

The payment network Visa achieved 47,000 peak transactions per second (tps) on its network during the 2013 holidays2, and currently averages hundreds of millions per day. Currently, Bitcoin supports less than 7 transactions per second with a 1 megabyte block limit. If we use an average of 300 bytes per bitcoin transaction and assumed unlimited block sizes, an equivalent capacity to peak Visa transaction volume of 47,000/tps would be nearly 8 gigabytes per Bitcoin block, every ten minutes on average. Continuously, that would be over 400 terabytes of data per year.

支付網路 Visa 在 2013 假期期間2,在其網路上每秒實現 47000 交易(TPS),目前實現平 均每天數億筆交易。目前,比特幣因為 1 MB塊的限制,每秒僅支持小於 7 筆交易。如果 每次比特幣交易我們平均用 300 Byte,並假設塊大小無限制,達到與 Visa 峰值 47000 / TPS 的交易量同等資料容量意味著每十分鐘每比特幣區塊將近 8 GB資料。持續下去,每年的資料將超過 400 TB。

Clearly, achieving Visa-like capacity on the Bitcoin network isn’t feasible today. No home computer in the world can operate with that kind of bandwidth and storage. If Bitcoin is to replace all electronic payments in the future, and not just Visa, it would result in outright collapse of the Bitcoin network, or at best, extreme centralization of Bitcoin nodes and miners to the only ones who could afford it. This centralization would then defeat aspects of network decentralization that make Bitcoin secure, as the ability for entities to validate the chain is what allows Bitcoin to ensure ledger accuracy and security.

顯然,如今在比特幣網路上獲得 Visa 般的能力是不可行的。在世界上沒有家用電腦可以有那樣的頻寬和儲存。如果比特幣在未來替換所有的電子支付,而不僅僅是 Visa,這將導致比特幣網路的徹底崩潰,或者在最好的情況下,只有可以支付得起的比特幣節點和礦工可以使用。這種集中化會再次打敗網路分散化,使比特幣安全成為具有確保總帳的準確性和安全性 的能力的實體。

Having fewer validators due to larger blocks not only implies fewer individuals ensuring ledger accuracy, but also results in fewer entities that would be able to validate the blockchain as part of the mining process, which results in encouraging miner centralization. Extremely large blocks, for example in the above case of 8 gigabytes every 10 minutes on average, would imply that only a few parties would be able to do block validation. This creates a great possibility that entities will end up trusting centralized parties. Having privileged, trusted parties creates a social trap whereby the central party will not act in the interest of an individual (principalagent problem), e.g. rentierism by charging higher fees to mitigate the incentive to act dishonestly. In extreme cases, this manifests as individuals sending funds to centralized trusted custodians who have full custody of customers’ funds. Such arrangements, as are common today, create severe counterparty risk. A prerequisite to prevent that kind of centralization from occurring would require the ability for bitcoin to be validated by a single consumer-level computer on a home broadband connection. By ensuring that full validation can occur cheaply, Bitcoin nodes and miners will be able to prevent extreme centralization and trust, which ensures extremely low transaction fees.

由於較大區塊而只有更少的驗證器不僅意味著更少數量的個人來確保總帳精度,也導致在開采過程中較少的實體能夠驗證區塊鏈,這將鼓勵礦工集中化。非常大的區塊,例如在上述情況下平均每 10 分鐘 8 GB,將意味著只有少數能夠驗證區塊。這就產生了一個實體會相信集中方的可能性。有特權的,值得信賴的集中方創建一個社交陷阱,由此集中方不 會在以個人(委託-代理問題)的利益為主,如承租人通過收取較高的手續費,以減輕行事不誠實的傾向。在極端的情況下,這表現為個人給擁有客戶資金的充分的監管權的集中方發送資金。這樣的安排,如今是非常常見的,產生嚴重的交易對方風險。防止那種集權發生的一個先決條件需要比特幣有這樣一種能力,通過在家用寬頻連線的單一電腦進行驗證。通過 確保以較低的資金獲得充分的驗證,比特幣節點和礦工將能夠避免極端的集權和信任,確保極低的交易手續費。

While it is possible that Moore’s Law will continue indefinitely, and the computational capacity for nodes to cost-effectively compute multigigabyte blocks may exist in the future, it is not a certainty.

摩爾定律無限期地繼續是有可能的,並且在未來,能使節點具有以低成本高效益的計算多GB的區塊的計算能力,但是那不是確定的。

To achieve much higher than 47,000 transactions per second using Bitcoin requires conducting transactions off the Bitcoin blockchain itself. It would be even better if the bitcoin network supported a near-unlimited number of transactions per second with extremely low fees for micropayments. Many micropayments can be sent sequentially between two parties to enable any size of payments. Micropayments would enable unbunding, less trust and commodification of services, such as payments for per-megabyte internet service. To be able to achieve these micropayment use cases, however, would require severely reducing the amount of transactions that end up being broadcast on the global Bitcoin blockchain.

為了實現用比特幣進行每秒多於 47000 筆交易,需要脫離比特幣區塊鏈本身進行交易。 如果比特幣網路支援以極低的手續費每秒進行近乎無限數量的小額交易會更好。許多小額支付 可以按順序在兩方之間發送,使任何大小的付款成為可能。小額支付將使服務變得非捆束, 少信任,商品化。如支付每MB的互聯網服務。為了能夠實現這些小額用例,將需要嚴重 降低最終被廣播的全球比特幣區塊鏈交易的數量。

While it is possible to scale at a small level, it is absolutely not possible to handle a large amount of micropayments on the network or to encompass all global transactions. For bitcoin to succeed, it requires confidence that if it were to become extremely popular, its current advantages stemming from decentralization will continue to exist. In order for people today to believe that Bitcoin will work tomorrow, Bitcoin needs to resolve the issue of block size centralization effects; large blocks implicitly create trusted custodians and significantly higher fees.

雖然可以在一個小規模水準上進行,在網路上處理大量小額支付或者包含全球交易是絕對不可能的。比特幣若想成功,它需要這樣一種信心,如果它能變得非常流行,其目前的由權力下放所產生的優勢將繼續存在。為了讓今天的人們相信比特幣在將來能有用,比特幣需要解決區塊大小集中效果;大區塊自主創建值得信賴的保管人和高手續費的問題。

2 小額支付通道可以解決可擴展性問題 A Network of Micropayment Channels Can Solve Scalability

“If a tree falls in the forest and no one is around to hear it, does it make a sound?”

“如果一棵樹倒在森林裡,周圍沒有人聽到它,它會發出聲音嗎?”

The above quote questions the relevance of unobserved events —if nobody hears the tree fall, whether it made a sound or not is of no consequence. Similarly, in the blockchain, if only two participants care about an everyday recurring transaction, it’s not necessary for all other nodes in the bitcoin network to know about that transaction. It is instead preferable to only have the bare minimum of information on the blockchain. By deferring telling the entire world about every transaction, doing net settlement of their relationship at a later date enables Bitcoin users to conduct many transactions without bloating up the blockchain or creating trust in a centralized counterparty. An effectively trustless structure can be achieved by using time locks as a component to global consensus.

上面的引文質疑未觀察事件的相關性 - 如果沒有人聽到樹倒下,它是否發出聲音是無關緊要的。 類似地,在區塊鏈中,如果只有兩個參與者關心日常重複交易,則比特幣網絡中的所有其他節點不必知道該交易。 相反,最好只有區塊鏈上最少的信息。 通過推遲向全世界講述每筆交易,在以後對其關係進行淨結算使得比特幣用戶能夠進行許多交易,而不會使區塊鏈膨脹或在集中交易對方中建立信任。 通過使用時間鎖作為全球共識的組成部分,可以實現有效無信任的結構。

Currently the solution to micropayments and scalability is to offload the transactions to a custodian, whereby one is trusting third party custodians to hold one’s coins and to update balances with other parties. Trusting third parties to hold all of one’s funds creates counterparty risk and transaction costs.

目前的小額支付和可擴展性解決方案將交易轉交給一個託管人,由一個被信任的協力廠商託管來持有硬幣並更新與其他各方的餘額情況。信任協力廠商來保存所有的人的資金可能產生交易對方風險和交易成本。

Instead, using a network of these micropayment channels, Bitcoin can scale to billions of transactions per day with the computational power available on a modern desktop computer today. Sending many payments inside a given micropayment channel enables one to send large amounts of funds to another party in a decentralized manner. These channels are not a separate trusted network on top of bitcoin. They are real bitcoin transactions.

相反,使用這些小額支付通道的網路,比特幣可以擴展到當今在現代筆記型電腦上以強大的計算能力進行數十億美元的交易。在一個小額支付通道中進行大量支付使人們能夠以分散的方式發送大量的資金給另一方。這些通道在比特幣上不是一個單獨的可信網路。他們是真正的比特幣交易。

Micropayment channels34 create a relationship between two parties to perpetually update balances, deferring what is broadcast to the blockchain in a single transaction netting out the total balance between those two parties. This permits the financial relationships between two parties to be trustlessly deferred to a later date, without risk of counterparty default. Micropayment channels use real bitcoin transactions, only electing to defer the broadcast to the blockchain in such a way that both parties can guarantee their current balance on the blockchain; this is not a trusted overlay network —payments in micropayment channels are real bitcoin communicated and exchanged off-chain.

小額支付通道34在雙方之間建立起關係,來更新餘額,決定在雙方交易時產生的總餘額中被推遲廣播到區塊鏈的部分。這使得雙方之間的財務關係被不可信地推遲到以後的日子,沒有交易對方違約的風險。小額支付通道使用真實的比特幣交易,只有通過選舉的方式來決定推遲在區塊鏈中廣播的部分,雙方才可以保證其在區塊鏈上現有的餘額;這不是值得信賴的覆蓋網路-在小額支付通道發生的支付是真正比特幣 off-chain 的溝通與交換。

2.1 小額支付通道不要求信託 Micropayment Channels Do Not Require Trust

Like the age-old question of whether the tree falling in the woods makes a sound, if all parties agree that the tree fell at 2:45 in the afternoon, then the tree really did fall at 2:45 in the afternoon. Similarly, if both counterparties agree that the current balance inside a channel is 0.07 BTC to Alice and 0.03 BTC to Bob, then that’s the true balance. However, without cryptography, an interesting problem is created: If one’s counterparty disagrees about the current balance of funds (or time the tree fell), then it is one’s word against another. Without cryptographic signatures, the blockchain will not know who owns what.

就像樹倒在樹林裡是否發出聲音的老問題,如各方均同意該樹在 2:45 倒下,那麼該樹確實在下午 2:45 倒下。同樣,如果雙方均同意,通道內現有的餘額為 0.07 BTC 給 Alice 和 0.03 BTC 給 Bob,那麼這就是真正的餘額。然而,如果沒有密碼,一個有趣的問題產生了:如果其中一方不同意有關資金的當前餘額(樹倒下的時間),那麼雙方就產生了分歧。如果沒有加密 的簽名,區塊鏈就不知道誰擁有什麼。

If the balance in the channel is 0.05 BTC to Alice and 0.05 BTC to Bob, and the balance after a transaction is 0.07 BTC to Alice and 0.03 BTC to Bob, the network needs to know which set of balances is correct. Blockchain transactions solve this problem by using the blockchain ledger as a timestamping system. At the same time, it is desirable to create a system which does not actively use this timestamping system unless absolutely necessary, as it can become costly to the network.

如果在通道中的餘額為 0.05 BTC 給 Alice 和 0.05 BTC 給 Bob,一個交易後的餘額為 0.07 BTC 給 Alice 和 0.03 BTC 給 Bob,網路需要知道哪個餘額集是正確的。區塊鏈交易通過使用區塊鏈總帳作為時間系統解決了這個問題。與此同時,希望建立一個系統,該系統除必要情況不積極地使用該時間戳記系統,因為它對於網路來說是昂貴的。

Instead, both parties can commit to signing a transaction and not broadcasting this transaction. So if Alice and Bob commit funds into a 2-of-2 multisignature address (where it requires consent from both parties to create spends), they can agree on the current balance state. Alice and Bob can agree to create a refund from that 2-of-2 transaction to themselves, 0.05 BTC to each. This refund is not broadcast on the blockchain. Either party may do so, but they may elect to instead hold onto that transaction, knowing that they are able to redeem funds whenever they feel comfortable doing so. By deferring broadcast of this transaction, they may elect to change this balance at a future date.

相反,雙方可以承諾簽署一個交易,但並不廣播該交易。因此,如果 Alice 和 Bob 投入資金到 2-of-2 多重簽名地址(其要求雙方同意來產生花費),他們都同意目前的餘額狀態。Alice 和 Bob 可以要求從 2-of-2 交易中退款給自己,每人 0.05 BTC。這份退款不會被廣播到區塊鏈。任何一方都可以這樣做,但他們更可能選擇堅持進行該交易,明知自己有能力在自己希望時撤回資金。通過推遲本次交易的廣播,他們可能會選擇在未來某一日期改變這種餘額。

To update the balance, both parties create a new spend from the 2-of-2 multisignature address, for example 0.07 to Alice and 0.03 to Bob. Without proper design, though, there is the timestamping problem of not knowing which spend is correct: the new spend or the original refund.

要更新這種餘額,雙方產生 2-of-2 的多重簽名地址的新支出,例如 0.07 給 Alice 和 0.03 給 Bob。如果沒有適當的設計,會產生時間戳記問題,不知道哪一項花費是正確的:新的支出還是原來的退款。

The restriction on timestamping and dates, however, is not as complex as full ordering of all transactions as in the bitcoin blockchain. In the case of micropayment channels, only two states are required: the current correct balance, and any old deprecated balances. There would only be a single correct current balance, and possibly many old balances which are deprecated.

在時間戳記和日期上的限制,不是像在比特幣區塊鏈一樣複雜和有序。在小額通道的情況下,只有兩個狀態是必需的:當前的正確的餘額,和任何舊的棄用餘額。只會有一個正確的現有餘額,可能有很多不建議使用的舊餘額。

Therefore, it is possible in bitcoin to devise a bitcoin script whereby all old transactions are invalidated, and only the new transaction is valid. Invalidation is enforced by a bitcoin output script and dependent transactions which force the other party to give all their funds to the channel counterparty. By taking all funds as a penalty to give to the other, all old transactions are thereby invalidated.

因此,在比特幣中可以設計比特幣腳本,從而使所有舊交易無效,並且只有新交易有效。 失效由比特幣輸出腳本和依賴交易強制執行,這迫使另一方將所有資金提供給通道對方。 通過將所有資金作為懲罰給予對方,所有舊交易因此無效。

This invalidation process can exist through a process of channel consensus where if both parties agree on current ledger states (and building new states), then the real balance gets updated. The balance is reflected on the blockchain only when a single party disagrees. Conceptually, this system is not an independent overlay network; it is more a deferral of state on the current system, as the enforcement is still occurring on the blockchain itself (albeit deferred to future dates and transactions).

這種失效過程可通過通道的共識,其中,如果雙方都同意目前的分類帳狀態(和建立新的狀態)過程存在,那麼真正的餘額得到更新。僅在一個單一方不同意時才在區塊鏈上反映出來。從概念上講,這種系統不是一個獨立的覆蓋網路;它是在現行系統上的一個延遲的狀態,因為強制執行仍在區塊鏈上發生(儘管推遲到將來的日期和交易)。

2.2 通道網路 A Network of Channels

Thus, micropayment channels only create a relationship between two parties. Requiring everyone to create channels with everyone else does not solve the scalability problem. Bitcoin scalability can be achieved using a large network of micropayment channels.

因此,小額支付通道只創立雙方之間的關係。要求大家與其他人建立通道不解決擴展性問題。比特幣的可擴展性可以通過小額支付通道的一個大的網路來實現。

If we presume a large network of channels on the Bitcoin blockchain, and all Bitcoin users are participating on this graph by having at least one channel open on the Bitcoin blockchain, it is possible to create a near-infinite amount of transactions inside this network. The only transactions that are broadcasted on the Bitcoin blockchain prematurely are with uncooperative channel counterparties.

如果我們假定一個比特幣區塊鏈通道的大型網路,並且所有參與的比特幣用戶在比特幣區塊鏈上具有至少一個開放通道,在該網路內可以創建近於無限量的交易。在比特幣區塊鏈上過早地廣播的唯一的交易是存在不合作通道對方的交易。

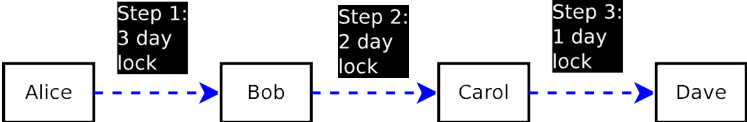

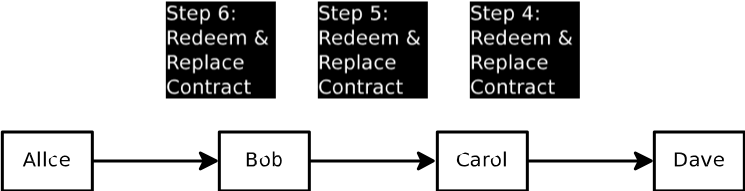

By encumbering the Bitcoin transaction outputs with a hashlock and timelock, the channel counterparty will be unable to outright steal funds and Bitcoins can be exchanged without outright counterparty theft. Further, by using staggered timeouts, it’s possible to send funds via multiple intermediaries in a network without the risk of intermediary theft of funds.

通過雜湊鏈和時間鏈延遲比特幣交易輸出,通道對方將無法直接竊取資金和比特幣可以在無對方竊取的情況下直接交換。此外,通過使用交錯休息,在沒有資金仲介竊取的風險的條件下通過多個在網路中的仲介機構發送資金成為可能。

3 雙向支付通道 Bidirectional Payment Channels

Micropayment channels permit a simple deferral of a transaction state to be broadcast at a later time. The contracts are enforced by creating a responsibility for one party to broadcast transactions before or after certain dates. If the blockchain is a decentralized timestamping system, it is possible to use clocks as a component of decentralized consensus5 to determine data validity, as well as present states as a method to order events6.

小額支付通道允許交易狀態簡單推遲至稍後時間廣播。該合約是以這樣的方式執行,創造一方在一定日期之前或之後廣播交易的責任。如果區塊鏈是一個分散化的時間戳記系統,它可以使用時鐘作為分散共識5的組成部分,以確定資料有效性,以及展示當前狀態作為訂購事件的方法6。

By creating timeframes where certain states can be broadcast and later invalidated, it is possible to create complex contracts using bitcoin transaction scripts. There has been prior work for Hub-and-Spoke Micro-payment Channels789.(and trusted payment channel networks1011) looking at building a hub-and-spoke network today. However, Lightning Network’s bidirectional micropayment channel requires the malleability soft-fork described in Appendix A to enable near-infinite scalability while miti-gating risks of intermediate node default.

通過創建特定狀態的廣播或失效的時間表,就可以使用比特幣交易腳本創建複雜的合約。已經有前期工作的中心輻射型小額支付通道789(和值得信賴的支付通道網路1011)監控今日建立樞紐和輻射網路的過程。然而,閃電定位網路的雙向小額通道要求在附錄 A 中所述的可塑性 Softfork,使在控制中間節點出錯風險時有近乎於無限的可擴展性。

By chaining together multiple micropayment channels, it is possible to create a network of transaction paths. Paths can be routed using a BGP-like system, and the sender may designate a particular path to the recipient. The output scripts are encumbered by a hash, which is generated by the recipient. By disclosing the input to that hash, the recipient’s counterparty will be able to pull funds along the route.

通過把多個微支付通道串聯起來,有可能創建交易路徑的網路。路徑可以使用類似 BGP 的系統進行路由,並且發送方可以指定一個特殊的路徑給收件人。輸出腳本由接收者產生的雜湊密碼限制。通過公開的輸入雜湊密碼,收件人的對方就能沿線拉動資金。

3.1 頻道創建中存在的問題

In order to participate in this payment network, one must create a micropayment channel with another participant on this network.

為了參加本次支付網路,我們必須與其他參與者創建這個網路上的小額支付通道。

3.1.1 創建無簽署的資金交易 The Problem of Blame in Channel Creation

An initial channel Funding Transaction is created whereby one or both channel counterparties fund the inputs of this transaction. Both parties create the inputs and outputs for this transaction but do not sign the transaction.

最初的提供的資金交易的通道創建起來是由通道的一方或者雙方輸入本次交易的資金。雙方建立這項交易的輸入和輸出,但不簽署交易。

The output for this Funding Transaction is a single 2-of-2 multisigna- ture script with both participants in this channel, henceforth named Alice and Bob. Both participants do not exchange signatures for the Funding Transaction until they have created spends from this 2-of-2 output refunding the original amount back to its respective funders. The purpose of not signing the transaction allows for one to spend from a transaction which does not yet exist. If Alice and Bob exchange the signatures from the Funding Transaction without being able to broadcast spends from the Funding Transaction, the funds may be locked up forever if Alice and Bob do not cooperate (or other coin loss may occur through hostage scenarios whereby one pays for the cooperation from the counterparty).

對於這筆資金交易的輸出是參加這個通道雙方的 2-of-2 的多重簽名,今後命名為 Alice 和 Bob 腳本。這兩個參與者沒有為資金交易交換簽名,直到他們已經從 2-of-2 得到了與原來金額相等的退還金額。未簽署交易的目的,是允許從一個尚不存在一個交易中花費。如果 Alice 和 Bob 在資金交易中交換了簽名,而不能得到資金交易的廣播,而且如果 Alice 和 Bob 不配合,資金可能會被永久的鎖定(或由一方承擔不合作的損失)。

Alice and Bob both exchange inputs to fund the Funding Transaction (to know which inputs are used to determine the total value of the channel), and exchange one key to use to sign with later. This key is used for the 2-of-2 output for the Funding Transaction; both signatures are needed to spend from the Funding Transaction, in other words, both Alice and Bob need to agree to spend from the Funding Transaction.

Alice 和 Bob 雙方交換輸入來提供資金交易所需資金(知道哪些輸入用於確定通道的總價值),來交換之後用來簽署的鑰匙。此鑰匙用於資金交易的 2-of-2 輸出;資金花費的產生需要雙方的簽署,換句話說,Alice 和 Bob 必須同意從資金交易中的資金花費。

3.1.2 來自未簽署交易的消費 Spending from an Unsigned Transaction

The Lightning Network uses a SIGHASH NOINPUT transaction to spend from this 2-of-2 Funding Transaction output, as it is necessary to spend from a transaction for which the signatures are not yet exchanged. SIGHASH NOINPUT, implemented using a soft-fork, ensures transactions can be spent from before it is signed by all parties, as transactions would need to be signed to get a transaction ID without new sighash flags. Without SIGHASH NOINPUT, Bitcoin transactions cannot be spent from before they may be broadcast —it’s as if one could not draft a contract without paying the other party first. SIGHASH NOINPUT resolves this problem. See Appendix A for more information and implementation.

閃電網路使用的是 SIGHASH NOINPUT 交易,從 2-of-2 輸出資金交易花費,因為這對於從尚未交換其簽名的交易上花費是必須的。SIGHASH NOINPUT,用 Softfork 實施,確保交易能夠在各方簽署之前執行,因為交易需要登錄才能獲取沒有新的 sighash flags 交易。如果沒有 SIGHASH NOINPUT,比特幣交易無法在廣播之前進行-就好像一個人不能在沒有支付對方的前提下得到草本。 SIGHASH NOINPUT 解決了這一問題。更多的資訊和實施見附錄 A。

Without SIGHASH NOINPUT, it is not possible to generate a spend from a transaction without exchanging signatures, since spending the Funding Transaction requires a transaction ID as part of the signature in the child’s input. A component of the Transaction ID is the parent’s (Funding Transaction’s) signature, so both parties need to exchange their signatures of the parent transaction before the child can be spent. Since one or both parties must know the parent’s signatures to spend from it, that means one or both parties are able to broadcast the parent (Funding Transaction) before the child even exists. SIGHASH NOINPUT gets around this by permitting the child to spend without signing the input. With SIGHASH NOINPUT, the order of operations are to:

- Create the parent (Funding Transaction)

- Create the children (Commitment Transactions and all spends from the commitment transactions)

- Sign the children

- Exchange the signatures for the children

- Sign the parent

- Exchange the signatures for the parent

- Broadcast the parent on the blockchain

如果沒有 SIGHASH NOINPUT,不可能產生在不交換簽名的情況下進行交易支出,因為花費的資金交易需要一個交易 ID 作為子輸入簽名的一部分。交易 ID 的一個組成部分是父(交易資金的來源)的簽名,因此雙方需要交換自己的父簽名子輸入才可以花費。由於一方或雙方必須知道父簽名因而由它來消費,這意味著一方或雙方都能夠在子輸入存在之前廣播父簽名(融資交易)。SIGHASH NOINPUT 通過允許子輸入無需登錄輸入就可消費來解決這個問題。SIGHASH NOINPUT 的操作順序是:

- 創建父輸入(融資交易)

- 創建子輸入(承諾交易及從承諾交易的所有花費)

- 登錄子輸入

- 交換子簽名

- 簽署父簽名

- 交換父簽名

- 廣播區塊鏈上的父簽名

One is not able to broadcast the parent (Step 7) until Step 6 is complete. Both parties have not given their signature to spend from the Funding Transaction until step 6. Further, if one party fails during Step 6, the parent can either be spent to become the parent transaction or the inputs to the parent transaction can be double-spent (so that this entire transaction path is invalidated).

一方不能夠廣播父簽名(步驟 7),直到步驟 6 完成。雙方直到步驟 6 才交換他們資金交易 的簽名。此外,如果步驟 6 中一方出現故障,父輸入可以成為父交易或者父交易會產生雙花(這樣,整個交易路徑無效)。

3.1.3 承諾交易:不可執行的結構 Commitment Transactions: Unenforcible Construction

After the unsigned (and unbroadcasted) Funding Transaction has been created, both parties sign and exchange an initial Commitment Transaction. These Commitment Transactions spends from the 2-of-2 output of the Funding Transaction (parent). However, only the Funding Transaction is broadcast on the blockchain.

無簽署(和無廣播)資金交易創建後,雙方簽署並交換了最初的承諾交易。這些承諾交易花 費來自於 2-of-2 的資金交易(父)輸出。但是,只有資金交易在區塊鏈上廣播。

Since the Funding Transaction has already entered into the blockchain, and the output is a 2-of-2 multisignature transaction which requires the agreement of both parties to spend from, Commitment Transactions are used to express the present balance. If only one 2-of-2 signed Commitment Transaction is exchanged between both parties, then both parties will be sure that they are able to get their money back after the Funding Transaction enters the blockchain. Both parties do not broadcast the Commitment Transactions onto the blockchain until they want to close out the current balance in the channel. They do so by broadcasting the present Commitment Transaction.

由於資金交易已經進入區塊鏈,輸出為需要雙方的協定的 2-of-2 的多重簽名交易,承諾交易是用來表達目前的餘額。只有一個 2-of-2 簽字承諾交易在雙方之間進行交換,那麼雙方將確保他們能拿回自己投入區塊鏈資金交易的錢。雙方不在區塊鏈廣播承諾交易到直到他們想從通道中停止現有的餘額。他們通過廣播現有的承諾交易來達到此目的。

Commitment Transactions pay out the respective current balances to each party. A naive (broken) implementation would construct an unbroadcasted transaction whereby there is a 2-of-2 spend from a single transaction which have two outputs that return all current balances to both channel counterparties. This will return all funds to the original party when creating an initial Commitment Transaction.

承諾交易支付當前餘額的相應每一方。一個單純(破碎)的實施將構建一個不廣播交易,借此有從單一的交易方到交易對方的 2-of-2 的支出,這個單一的交易方具有兩個返回當前餘額的輸出。這將創建一個初始的承諾交易,返回原方所有的資金。

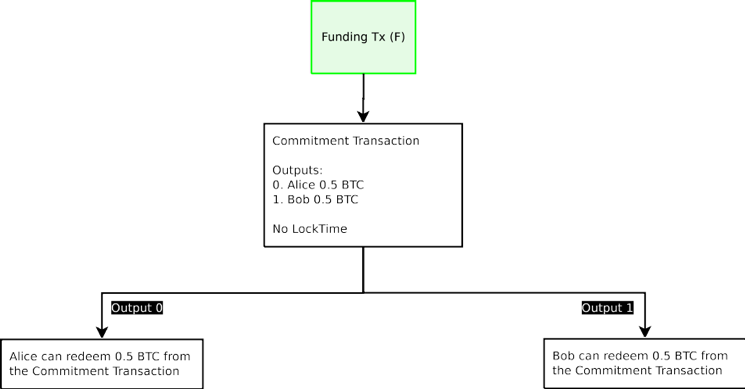

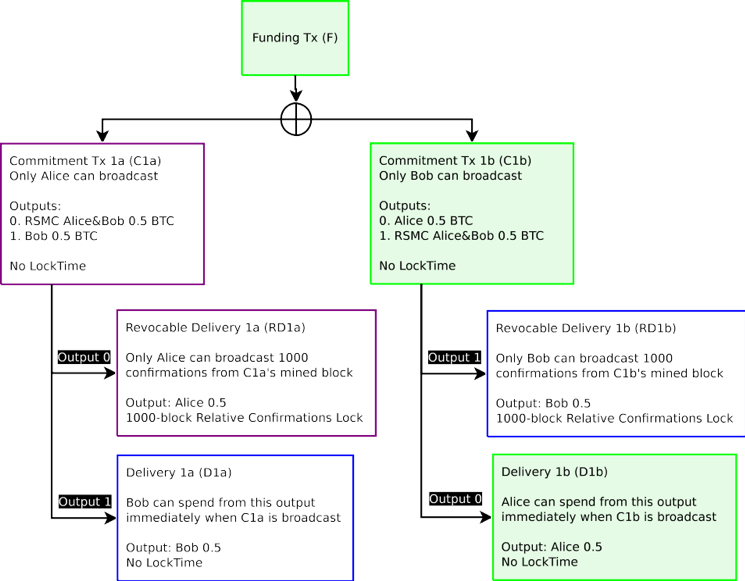

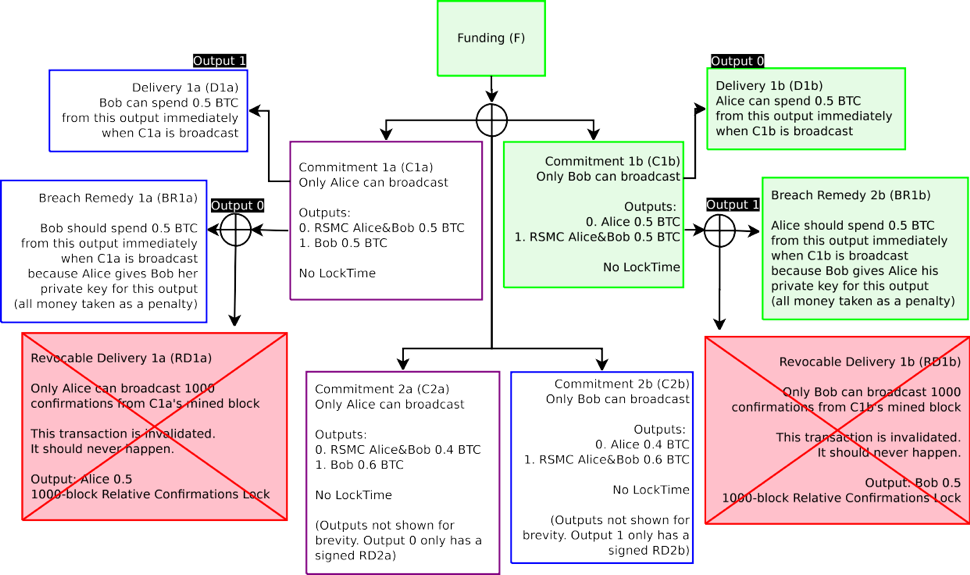

Figure 1: A naive broken funding transaction is described in this diagram. The Funding Transaction (F), designated in green, is broadcast on the blockchain after all other transactions are signed. All other transactions spending from the funding transactions are not yet broadcast, in case the counterparties wish to update their balance. Only the Funding Transaction is broadcast on the blockchain at this time.

圖 1:一個真正破碎的資金交易將在本圖中描述。資金交易(F),被標記為綠色,在所有其他交易簽署後被廣播被區塊鏈上。從資金交易支出的所有其他交易都還沒有廣播,以防對方想要更新自己的餘額。只有在這個時候,資金交易才能廣播在區塊鏈上。

For instance, if Alice and Bob agree to create a Funding Transaction with a single 2-of-2 output worth 1.0 BTC (with 0.5 BTC contribution from each), they create a Commitment Transaction where there are two 0.5 BTC outputs for Alice and Bob. The Commitment Transactions are signed first and keys are exchanged so either is able to broadcast the Commitment Transaction at any time contingent upon the Funding Transaction entering into the blockchain. At this point, the Funding Transaction signatures can safely be exchanged, as either party is able to redeem their funds by broadcasting the Commitment Transaction.

例如,如果 Alice 和 Bob 同意用 2-of-2 輸出來創建一個價值 1.0 BTC(各自貢獻 0.5 BTC)的資金交易,他們創造一個有分別來自 Alice 和 Bob 兩個輸出的承諾交易。該承諾首先應被簽署,並且交換金鑰,因此交易雙方能在與資金交易進入區塊鏈的任意合適的時間來公布承諾交易。在這一點上,資金交易簽名可以安全地進行交換,因為任何一方能夠通過廣播的承諾交易贖回自己的資金。

This construction breaks, however, when one wishes to update the present balance. In order to update the balance, they must update their Commitment Transaction output values (the Funding Transaction has already entered into the blockchain and cannot be changed).

但是,這種結構在當一個人希望更新餘額時會斷裂。為了更新餘額,就必須更新自己的承諾交易的輸出值(融資交易已經進入區塊鏈,不能更改)。

When both parties agree to a new Commitment Transaction and exchange signatures for the new Commitment Transaction, either Commitment Transactions can be broadcast. As the output from the Funding Transaction can only be redeemed once, only one of those transactions will be valid. For instance, if Alice and Bob agree that the balance of the channel is now 0.4 to Alice and 0.6 to Bob, and a new Commitment Transaction is created to reflect that, either Commitment Transaction can be broadcast. In effect, one would be unable to restrict which Commitment Transaction is broadcast, since both parties have signed and exchanged the signatures for either balance to be broadcast.

當雙方都同意一個新的承諾交易並且為了新承諾交易交換簽名,任意承諾交易可以被廣播。輸出從資金交易中只能被贖回一次,這些交易中只有一個將是有效的。例如,如果 Alice 和 Bob 同意通道的餘額為 0.4 給 Alice 和 0.6 給 Bob,一個新的交易承諾將被重新創建並且任何承諾交易可以被廣播。事實上,為了被廣播的任何餘額,雙方都已經簽署了並交換了簽名,一方將無法限制其承諾交易是否廣播。

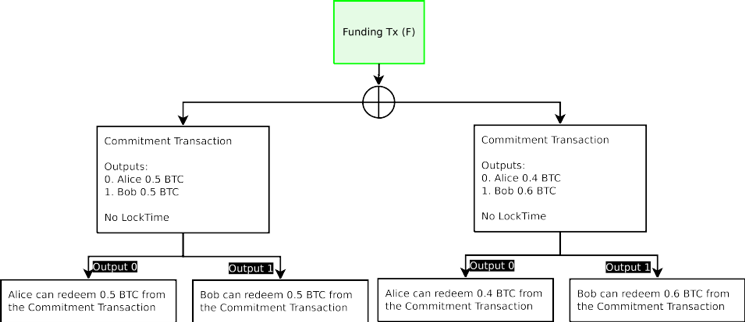

Figure 2: Either of the Commitment Transactions can be broadcast any any time by either party, only one will successfully spend from the single Funding Transaction. This cannot work because one party will not want to broadcast the most recent transaction.

圖 2:承諾交易可由任何一方在任何時間廣播,只有一方會從單一的資金交易中成功花費。這樣不行,因為一方不想廣播最新的交易。

Since either party may broadcast the Commitment Transaction at any time, the result would be after the new Commitment Transaction is generated, the one who receives less funds has significant incentive to broadcast the transaction which has greater values for themselves in the Commitment Transaction outputs. As a result, the channel would be immediately closed and funds stolen. Therefore, one cannot create payment channels under this model.

因為任何一方都可以在任何時間廣播承諾交易,其結果是,產生了新的承諾後,獲得資金少的人想廣播這承諾交易,在這承諾交易產出中對他們具有更大的價值。其結果是,該通道將被立即關閉並且資金被盜。因此,人們不能在這種模式下建立支付通道。

3.1.4 承諾交易:指出禍源 Commitment Transactions: Ascribing Blame

Since any signed Commitment Transaction may be broadcast on the blockchain, and only one can be successfully broadcast, it is necessary to prevent old Commitment Transactions from being broadcast. It is not possible to revoke tens of thousands of transactions in Bitcoin, so an alternate method is necessary. Instead of active revocation enforced by the blockchain, it’s necessary to construct the channel itself in similar manner to a Fidelity Bond, whereby both parties make commitments, and violations of these commitments are enforced by penalties. If one party violates their agreement, then they will lose all the money in the channel.

因為任何簽署的承諾交易可以被廣播在區塊鏈上,並且只有一個可以成功地廣播,有必要防止舊承諾交易被廣播。撤銷在比特幣上的幾萬交易是不可能的,所以另一種方法是必要的。相反,主動撤銷區塊鏈強制執行的交易,有必要以與富達債券類似的方式建立通道,即雙方都作出承諾,違反這些承諾被強制實施處罰。如果一方違反了他們的協議,那麼他們將失去所有在通道中的錢。

For this payment channel, the contract terms are that both parties commit to broadcasting only the most recent transaction. Any broadcast of older transactions will cause a violation of the contract, and all funds are given to the other party as a penalty.

對於這種支付通道,合約條款是:雙方承諾只廣播最近的交易,對舊交易的任何廣播將導致對合約的違反,所有的資金都作為懲罰送給對方。

This can only be enforced if one is able to ascribe blame for broadcasting an old transaction. In order to do so, one must be able to uniquely identify who broadcast an older transaction. This can be done if each counterparty has a uniquely identifiable Commitment Transaction. Both parties must sign the inputs to the Commitment Transaction which the other party is responsible for broadcasting. Since one has a version of the Commitment Transaction that is signed by the other party, one can only broadcast one’s own version of the Commitment Transaction.

這只有在一方能夠將責任歸咎於廣播舊交易的情況下才可以被執行。為了做到這一點,必須能夠準確的識別是誰廣播了一個舊交易。這是可以做到,如果雙方擁有唯一地可鑒定的承諾交易。雙方必須簽署承諾交易,而對方負責廣播。因為一方由對方簽署的一份交易承諾,一方只能廣播自己承諾交易的版本。

For the Lightning Network, all spends from the Funding Transaction output, Commitment Transactions, have two half-signed transactions. One Commitment Transaction in which Alice signs and gives to Bob (C1b), and another which Bob signs and gives to Alice (C1a). These two Commitment Transactions spend from the same output (Funding Transaction), and have different contents; only one can be broadcast on the blockchain, as both pairs of Commitment Transactions spend from the same Funding Transaction. Either party may broadcast their received Commitment Transaction by signing their version and including the counterparty’s signature. For example, Bob can broadcast Commitment C1b, since he has already received the signature for C1b from Alice —he includes Alice’s signature and signs C1b himself. The transaction will be a valid spend from the Funding Transaction’s 2-of-2 output requiring both Alice and Bob’s signature.

對於閃電網,一切花費從資金交易輸出,承諾交易有兩個半簽名交易。Alice 簽署一份承諾交易,給 Bob(C1b),另一半由 Bob 簽署,給 Alice(C1a)。這兩個承諾的花費來自於相同的輸出(融資交易),並有不同的內容;只有一個可以在區塊鏈廣播,因為交易承諾的兩部分來自同一交易的資金支出。任何一方都可以通過登錄包括交易對方簽名自己的版本,廣播其收到的承諾交易。例如,Bob 可以廣播承諾 C1b,因為他已經從 Alice 那裡收到了 C1b 的簽名-它包含了 Alice 的簽名和 C1b 的自己的簽名。該交易將會從 2-of-2 資金交易的輸出要求 Alice 和 Bob 的簽名有效支出。

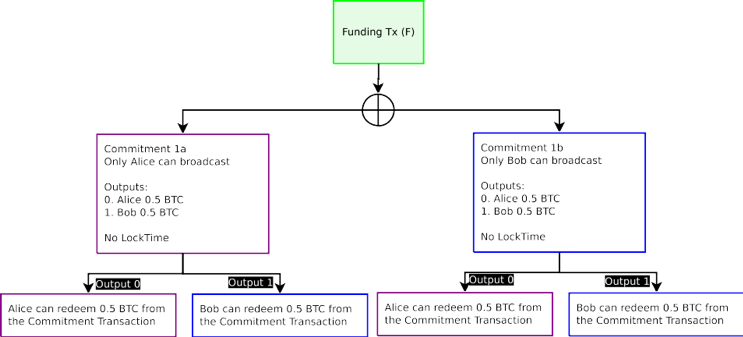

Figure 3: Purple boxes are unbroadcasted transactions which only Alice can broadcast. Blue boxes are unbroadcasted transaction which only Bob can broadcast. Alice can only broadcast Commitment 1a, Bob can only broadcast Commitment 1b. Only one Commitment Transaction can be spent from the Funding Transaction output. Blame is ascribed, but either one can still be spent with no penalty.

圖 3:紫框裡代表未被廣播只有 Alice 可以廣播的交易。籃框裡代表未被廣播只有 Bob 可以 廣播的交易。Alice 只能廣播承諾 1A,Bob 只能廣播承諾 1B。只有一個承諾交易可以從交易資金輸出中支出。錯誤根源已找出,但任何一方仍然可以花費並且不受懲罰。

However, even with this construction, one has only merely allocated blame. It is not yet possible to enforce this contract on the Bitcoin blockchain. Bob still trusts Alice not to broadcast an old Commitment Transaction. At this time, he is only able to prove that Alice has done so via a half-signed transaction proof.

然而,即使有這樣的結構,一個人僅僅只是被分配了責任。目前尚不可能在比特幣區塊鏈上執行本合約。Bob 仍然相信 Alice 不會廣播舊承諾交易。在這個時候,他只能夠證明,Alice 這樣做已經通過半簽名的交易證明。

3.2 創建撤銷合約的通道 Creating a Channel with Contract Revocation

To be able to actually enforce the terms of the contract, it’s necessary to construct a Commitment Transaction (along with its spends) where one is able to revoke a transaction. This revocation is achievable by using data about when a transaction enters into a blockchain and using the maturity of the transaction to determine validation paths.

為了能夠真正執行合約規定的條款,有必要構建一個承諾交易(連同其支出),為此其中一方就能夠撤銷交易。這個撤銷是可以通過使用交易進入一個區塊鏈資料來實現的,並通過使用該交易的成熟度來確定驗證路徑。

3.3 nSequence 成熟度 Sequence Number Maturity

Mark Freidenbach has proposed that Sequence Numbers can be enforcible via a relative block maturity of the parent transaction via a soft-fork12. This would allow some basic ability to ensure some form of relative block confirmation time lock on the spending script. In addition, an additional opcode, OP CHECKSEQUENCEVERIFY13 (a.k.a. OP RELATIVECHECKLOCKTIMEVERIFY)14, would permit further abilities, including allowing a stop-gap solution before a more permanent solution for resolving transaction malleability. A future version of this paper will include proposed solutions.

Mark Freidenbach 曾提出,nSequence 可以由父交易的相對區塊成熟度通過 Softfork12 執行。這將允許一些基本的能力來確保在消費腳本上的某種形式的相對區塊確認時間鏈。此外,額 外 的 操 作 碼 , OP CHECKSEQUENCEVERIFY 13( 又 名 OP RELATIVECHECKLOCKTIMEVERIFY)14,將允許更多的能力,包括允許一個權宜的解決方案,在更長久的解決方案提出之前用於解決交易延展性問題。本文的未來版本將包括提出的解決方案。

To summarize, Bitcoin was released with a sequence number which was only enforced in the mempool of unconfirmed transactions. The original behavior permitted transaction replacement by replacing transactions in the mempool with newer transactions if they have a higher sequence number. Due to transaction replacement rules, it is not enforced due to denial of service attack risks. It appears as though the intended purpose of the sequence number is to replace unbroadcasted transactions. However, this higher sequence number replacement behavior is unenforcible. One cannot be assured that old versions of transactions were replaced in the mempool and a block contains the most recent version of the transaction. A way to enforce transaction versions off-chain is via time commitments.

概括地說,具有順序號的比特幣被發行,這些順序號在無確認條件的記憶體池中被執行。原來的行為允許交易置換,如果他們具有較高的 nSequence,可通過在記憶體池中與較新的交易替換。根據交易替換規則,這不是由拒絕服務攻擊風險來執行。nSequence 的預期目的是替代未廣播的交易。然而,這種較高 nSequence 的替換行為是不可執行的。人們不能得到保證,交易的舊版本在記憶體池內已經被替換,一個區塊包含的是最新的版本。一種以 off-chain 形式執行交易版本的方法是通過時間承諾。

A Revocable Transaction spends from a unique output where the transaction has a unique type of output script. This parent’s output has two redemption paths where the first can be redeemed immediately, and the second can only be redeemed if the child has a minimum number of confirmations between transactions. This is achieved by making the sequence number of the child transaction require a minimum number of confirmations from the parent. In essence, this new sequence number behavior will only permit a spend from this output to be valid if the number of blocks between the output and the redeeming transaction is above a specified block height.

可撤銷交易花費從一個獨特輸出中支出,在此獨特的輸出中,交易具有一個獨特類型的輸出 腳本。父交易有 2 條贖回的路徑,其中第一個可以立即贖回,第二個是只有子交易達到一個 最小確認值才可贖回。子交易的 nSequence 的確定需要父交易的最小確認值。從本質上說,這種新的 nSequence 的行為將只能確認從特定輸出的支出是有效的,如果在輸出和贖回交易之間的區塊的數量超過了一個特定的區塊高度。

A transaction can be revoked with this sequence number behavior by creating a restriction with some defined number of blocks defined in the sequence number, which will result in the spend being only valid after the parent has entered into the blockchain for some defined number of blocks.

交易可以通過這些 nSequence 數位行為來贖回,通過一些特定數量的在 nSequence 中確認的區塊創建一個限制,這將導致支出只有在父交易為了一些特定數量的區塊進入區塊鏈之後是有效的。

This creates a structure whereby the parent transaction with this output becomes a bonded deposit, attesting that there is no revocation. A time period exists which anyone on the blockchain can refute this attestation by broadcasting a spend immediately after the transaction is broadcast.

這就產生了一個結構,其中父交易和該輸出變成粘結存款,證明沒有撤銷。在一段時間內區塊鏈上的任何人可以通過廣播交易之後立即廣播支出駁斥這種認證。

If one wishes to permit revocable transactions with a 1000- confirmation delay, the output transaction construction would remain a 2-of-2 multisig:

2 <Alice 1 > 2 OP CHECKMULTISIG

如果希望允許撤銷交易,這個交易有 1000 個確認延遲,該輸出交易結構將持有 2-of-2 的多信號結構:

待修正:2 <A L I 權證 1> 2 OP CHECKMULTISIG

However, the child spending transaction would contain a nSequence value of 1000. Since this transaction requires the signature of both counterparties to be valid, both parties include the nSequence number of 1000 as part of the signature. Both parties may, at their discretion, agree to create another transaction which supersedes that transaction without any nSequence number.

然而,子消費交易將包含 1000 個 nSequence 值,由於該交易需要雙方簽名來確認其有效性,雙方包括 1000 個 nSequence 作為簽名的一部分。雙方當事人可以自行決定,同意創建另一個交易來取代沒有 nSequence 的交易。

This construction, a Revocable Sequence Maturity Contract (RSMC), creates two paths, with very specific contract terms.

這種結構,可撤銷 nSequence 成熟合約(RSMC),通過非常確定的合約條款,創建兩個路徑。

The contract terms are:

- All parties pay into a contract with an output enforcing this contract

- Both parties may agree to send funds to some contract, with some waiting period (1000 confirmations in our example script). This is the revocable output balance.

- One or both parties may elect to not broadcast (enforce) the payouts until some future date; either party may redeem the funds after the waiting period at any time.

- If neither party has broadcast this transaction (redeemed the funds), they may revoke the above payouts if and only if both parties agree to do so by placing in a new payout term in a superseding transaction payout. The new transaction payout can be immediately redeemed after the contract is disclosed to the world (broadcast on the blockchain).

- In the event that the contract is disclosed and the new payout structure is not redeemed, the prior revoked payout terms may be redeemed by either party (so it is the responsibility of either party to enforce the new terms).

該合約的條款是:

- 所有各方簽訂一份合約,該合約有一個輸出來執行本合約 2. 雙方當事人同意在一個等待期(在我們的示例腳本中是 1000 個確認)內為一些合約集資,有。這是可撤銷的輸出餘額。

- 一方或雙方當事人可以選擇不廣播(執行)的支出,直到將來某個日期;任何一方都可以在等待期後隨時贖回資金。

- 如果雙方都沒有廣播本次交易(贖回資金),他們可能會撤銷上述支出,當且僅當雙方都同意通過在取代交易支付中放置一個新的支付期限。新的交易支付可以在該合約披露給世界後立即贖回(廣播在區塊鏈上)。

- 在合約被披露但新的支出結構不贖回的情況下,之前撤銷的支付條款可以由任何一方贖回(所以執行新條款是雙方中任何一方的責任)。

The pre-signed child transaction can be redeemed after the parent transaction has entered into the blockchain with 1000 confirmations, due to the child’s nSequence number on the input spending the parent.

預籤子交易可以在父交易已進入有 1000 個確認的區塊鏈之後被贖回,由於子 nSequence 取決於父交易的花費。

In order to revoke this signed child transaction, both parties just agree to create another child transaction with the default field of the nSequence number of MAX INT, which has special behavior permitting spending at any time.

為了撤銷這個簽署的子交易,雙方只是同意創建另一個子交易,該子交易的 nSequence 為 MAX INT,它有特殊的行為,允許在任何時候支出。

This new signed spend supersedes the revocable spend so long as the new signed spend enters into the blockchain within 1000 confirmations of the parent transaction entering into the blockchain. In effect, if Alice and Bob agree to monitor the blockchain for incorrect broadcast of Commitment Transactions, the moment the transaction gets broadcast, they are able to spend using the superseding transaction immediately. In order to broadcast the revocable spend (deprecated transaction), which spends from the same output as the superseding transaction, they must wait 1000 confirmations.

只要新簽署的支出進入父交易已經進入的有 1000 個確認的區塊鏈中,這個新簽署的支出將取代可撤銷的花費。事實上,如果 Alice 和 Bob 同意監測區塊鏈,以防其對承諾交易進行不正確廣播,當下交易一廣播,他們能夠立即使用替代交易進行花費。為了廣播可撤銷支出(不建議的交易),其花費與替代交易相同,他們必須等待 1000 個確認。

待處理:So long as both parties watch the blockchain, the revocable spend will never enter into the transaction if either party prefers the superseding transaction.

Using this construction, anyone could create a transaction, not broadcast the transaction, and then later create incentives to not ever broadcast that transaction in the future via penalties. This permits participants on the Bitcoin network to defer many transactions from ever hitting the blockchain.

採用這種結構,任何人都可以創建一個交易,不廣播交易,再後來建立激勵機制,使其在未來不通過處罰來廣播交易。這使得比特幣網路上的參與者可以推遲許多在區塊鏈上的交易。

3.3.1 Timestop

To mitigate a flood of transactions by a malicious attacker requires a credible threat that the attack will fail.

要減輕一個惡意的攻擊者製造的信度威脅。

Greg Maxwell proposed using a timestop to mitigate a malicious flood on the blockchain:

There are many ways to address this [flood risk] which haven’t been adequately explored yet —for example, the clock can stop when blocks are full; turning the security risk into more hold-up delay in the event of a dos attack.15

Greg Maxwell 提出使用停止狀態以減輕對區塊鏈惡意攻擊:

有很多方法可以解決這個問題[洪水風險],這個問題尚未得到充分的探討-例如,在區塊充足時候時鐘可以停止;在 Dos 攻擊事件15發生時,把安全風險轉化為更多的延遲。

This can be mitigated by allowing the miner to specify whether the current (fee paid) mempool is presently being flooded with transactions. They can enter a “1” value into the last bit in the version number of the block header. If the last bit in the block header contains a “1”, then that block will not count towards the relative height maturity for the nSequence value and the block is designated as a congested block. There is an uncongested block height (which is always lower than the normal block height). This block height is used for the nSequence value, which only counts block maturity (confirmations).

這可以通過讓礦工確認現有的(手續費支付)記憶體池目前是否交易氾濫來得到緩解。他們可以輸入一個“1”值到塊標題的版本號的最後一位。如果在塊標題的最後一位包含一個“1”,則該塊將不計入的相對成熟高度的 nSequence 值,並且該區塊被指定為一個擁擠區塊。有一不擁擠區塊高度(它總是比正常塊高度低)。此區塊高度用於確定 nSequence 價值,這只能算作區塊成熟(確認條件)。

A miner can elect to define the block as a congested block or not. The default code could automatically set the congested block flag as “1” if the mempool is above some size and the average fee for that set size is above some value. However, a miner has full discretion to change the rules on what automatically sets as a congested block, or can select to permanently set the congestion flag to be permanently on or off. It’s expected that most honest miners would use the default behavior defined in their miner and not organize a 51% attack.

一名礦工可以選擇區塊是否擁擠。如果記憶體池大於一定的規模或者對於確定大小的記憶體池的平均手續費大於一定的值,默認代碼可以自動設置擁擠區塊為“1”。然而,一個礦工有完全的決定權來改變確定自動設置為擁擠塊的規則,或者可以選擇是否設置為永久的擁擠。最誠實的礦工將使用默認的行為去定義他們的礦工,而不是組織一次 51% 的攻擊。

For example, if a parent transaction output is spent by a child with a nSequence value of 10, one must wait 10 confirmations before the transaction becomes valid. However, if the timestop flag has been set, the counting of confirmations stops, even with new blocks. If 6 confirmations have elapsed (4 more are necessary for the transaction to be valid), and the timestop block has been set on the 7th block, that block does not count towards the nSequence requirement of 10 confirmations; the child is still at 6 blocks for the relative confirmation value. Functionally, this will be stored as some kind of auxiliary timestop block height which is used only for tracking the timestop value. When the timestop bit is set, all transactions using an nSequence value will stop counting until the timestop bit has been unset. This gives sufficient time and block-space for transactions at the current auxiliary timestop block height to enter into the blockchain, which can prevent systemic attackers from successfully attacking the system.

例如,如果一個父交易輸出由一個 nSequence 值為 10 的子交易花費,在交易生效之前我們必須等待 10 次確認。然而,如果 timestop 已經確定,即使採用新的區塊,計算的確認也應 當停止。如果 6 次確認已經完成(再需要 4 次確認交易才是有效的),並且 timestop 區塊已設置的第七區塊上,該塊不要求 10 次 nSequence 的確認,孩子目前仍處於第 6 區塊相對確認值。在功能上,這將被儲存為某種輔助 timestop 區塊高度,僅用於跟蹤 timestop 值。當 timestop 位數已經設置,使用 nSequence 值的所有交易將停止計數,直到 timestop 位數恢復未設置狀態。這給當前輔助 timestop 區塊高度中的交易提供了充分的時間和區塊空間來進入區塊鏈,它可以防止系統攻擊者成功地攻擊系統。

However, this requires some kind of flag in the block to designate whether it is a timestop block. For full SPV compatibility (Simple Payment Verification; lightweight clients), it is desirable for this to be within the 80 byte block header instead of in the coinbase. There are two places which may be a good place to put in this flag in the block header: in the block time and in the block version. The block time may not be safe due to the last bits being used as an entropy source for some ASIC miners, therefore a bit may need to be consumed for timestop flags. Another option would be to hardcode timestop activation as a hard consensus rule (e.g. via block size), however this may make things less flexible. By setting sane defaults for timestop rules, these rules can be changed without consensus soft-forks.

然而,這需要區塊中的某種標誌指定它是否是一個 timestop 區塊。對於 SPV 完全相容性(簡單付款確認;羽量級用戶端),它要求在 80 Byte的區塊標頭內,而不是在 coinbase。在區塊標頭存放這一標誌的可能的兩個地方:區塊時間和區塊版本。區塊時間可能不安全,由於最後一位被一些 ASIC 的礦工用作熵源,因此可能需要一位元被消耗用於 timestop 標誌。另一種選擇是硬編碼 timestop 啟動,作為硬協商一致規則(例如,通過區塊大小),但是這可能使 事情變得不太靈活。通過設置 timestop 的健全的預設規則,這些規則可以不通過一致的 soft-forks 來改變。

If the block version is used as a flag, the contextual information must match the Chain ID used in some merge-mined coins.

如果區塊的版本被用作標誌,上下文資訊必須以某種合併開採硬幣中使用的鏈 ID 相匹配。

3.3.2 撤銷承諾交易 Revocable Commitment Transactions

By combining the ascribing of blame as well as the revocable transaction, one is able to determine when a party is not abiding by the terms of the contract, and enforce penalties without trusting the counterparty.

通過結合錯誤來源以及可撤銷交易,能夠確定什麼時候一方不遵守合約的條款,並不信任對方的實施處罰。

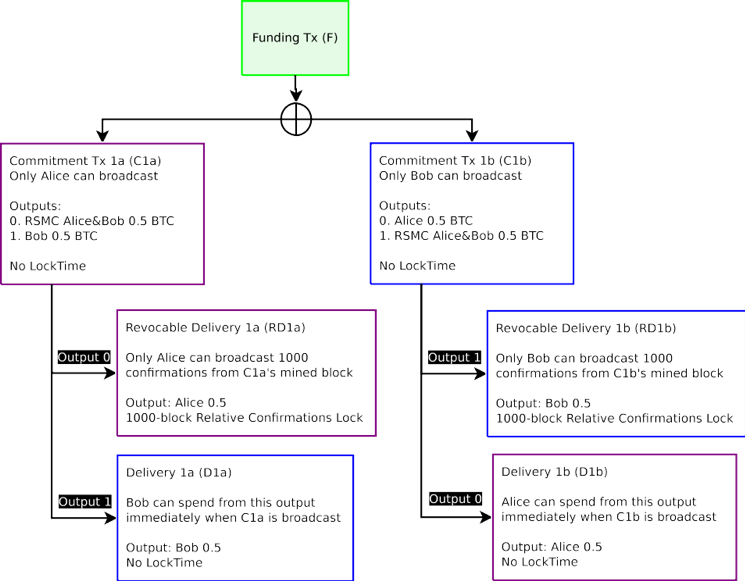

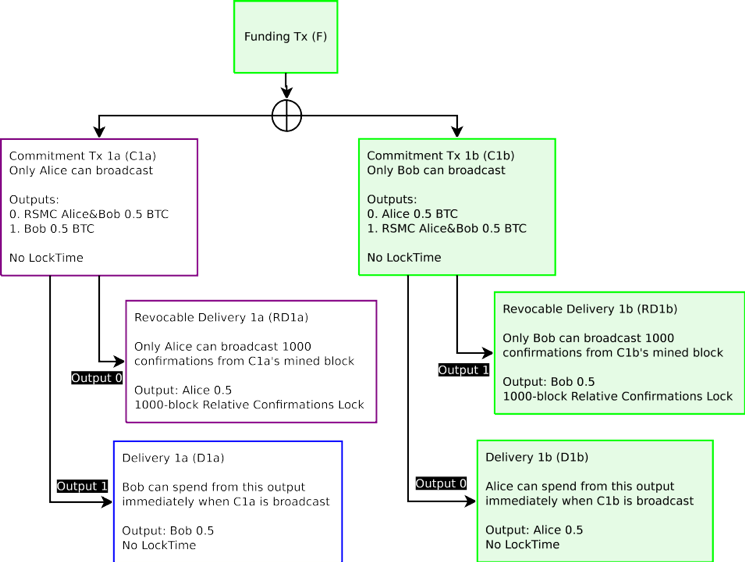

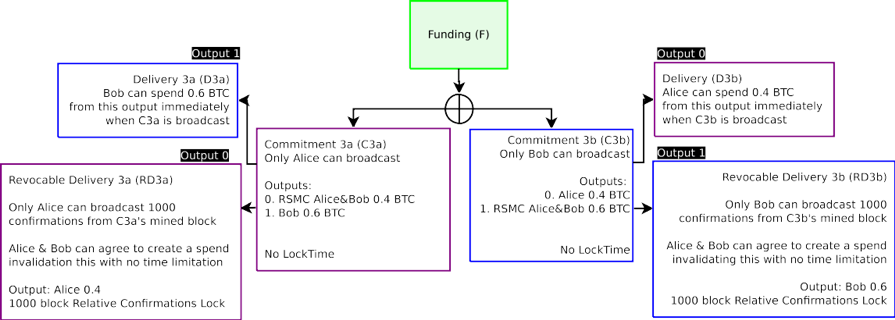

Figure 4: The Funding Transaction F, designated in green, is broadcast on the blockchain after all other transactions are signed. All transactions which only Alice can broadcast are in purple. All transactions which only Bob can broadcast is are blue. Only the Funding Transaction is broadcast on the blockchain at this time.

圖 4:資金交易 F,用綠色代表,在所有其他交易簽署之後在區塊鏈上廣播。所有交易只有 Alice 可以廣播的交易由紫色代表。所有只有 Bob 可以廣播的交易由藍色代表。此時,只有交易資金在區塊鏈上廣播。

The intent of creating a new Commitment Transaction is to invalidate all old Commitment Transactions when updating the new balance with a new Commitment Transaction. Invalidation of old transactions can happen by making an output be a Revocable Sequence Maturity Contract (RSMC). To invalidate a transaction, a superseding transaction will be signed and exchanged by both parties that gives all funds to the counterparty in the event an older transaction is incorrectly broadcast. The incorrect broadcast is identified by creating two different Commitment Transactions with the same final balance outputs, however the payment to oneself is encumbered by an RSMC.

創建一個新的承諾交易的目的是在利用新的承諾交易來更新新的餘額,使所有的舊的承諾交易無效。要使舊的交易失效,要使輸出成為可撤銷的序列到期合約(RSMC)。要使交易無效,將簽署一個替代的交易,並且雙方交換此交易,規定雙方在不正確的廣播舊交易的情況下將資金交給對方。不正確的廣播通過創建具有相同的網路最終餘額輸出的兩個不同承諾交易來鑒定,但是給自己的支付由 RSMC 擔保。

In effect, there are two Commitment Transactions from a single Funding Transaction 2-of-2 outputs. Of these two Commitment Transactions, only one can enter into the blockchain. Each party within a channel has one version of this contract. So if this is the first Commitment Transaction pair, Alice’s Commitment Transaction is defined as C1a, and Bob’s Commitment Transaction is defined as C1b. By broadcasting a Commitment Transaction, one is requesting for the channel to close out and end. The first two outputs for the Commitment Transaction include a Delivery Transaction (payout) of the present unallocated balance to the channel counterparties. If Alice broadcasts C1a, one of the output is spendable by D1a, which sends funds to Bob. For Bob, C1b is spendable by D1b, which sends funds to Alice. The Delivery Transaction (D1a/D1b) is immediately redeemable and is not encumbered in any way in the event the Commitment Transaction is broadcast.

實際上,2-of-2 資金交易輸出有兩個承諾交易。這兩個承諾交易中,只有一個可以進入到 區塊鏈。通道內的每一方都有本合約的一個版本。因此,如果這是第一個承諾交易對, Alice 的承諾交易被定義為 C1a, Bob 的承諾交易被定義為 C1b。若要廣播一個承諾交易,要求的通道關閉並結束。承諾交易的前兩個輸出包括目前未分配的與通道對方為分配餘額的交付交易(派息)。如果 Alice 廣播 C1a,其中一個輸出對 D1a 是可支配的,它發送資金給 Bob。 Bob,C1b 的是可由 D1b 支配的,它發送資金給 Alice。該交付交易(D1a / D1b)是被立即贖回的,並以任何方式廣播交易承諾不受到阻礙。

For each party’s Commitment Transaction, they are attesting that they are broadcasting the most recent Commitment Transaction which they own. Since they are attesting that this is the current balance, the balance paid to the counterparty is assumed to be true, since one has no direct benefit by paying some funds to the counterparty as a penalty.

對於每一方的承諾交易,他們證明他們正在廣播他們擁有最新的承諾交易。因為他們證明,這是當前餘額,支付給對方的餘額被認為是真實的,因為作為一種懲罰向對方支付資金對自己是沒有任何直接好處的。

The balance paid to the person who broadcast the Commitment Transaction, however, is unverified. The participants on the blockchain have no idea if the Commitment Transaction is the most recent or not. If they do not broadcast their most recent version, they will be penalized by taking all the funds in the channel and giving it to the counterparty. Since their own funds are encumbered in their own RSMC, they will only be able to claim their funds after some set number of confirmations after the Commitment Transaction has been included in a block (in our example, 1000 confirmations). If they do broadcast their most recent Commitment Transaction, there should be no revocation transaction superseding the revocable transaction, so they will be able to receive their funds after some set amount of time (1000 confirmations).

將餘額支付給廣播承諾交易的人是未確認的。區塊鏈上的參與者不知道承諾交易是否是最近的。如果他們沒有廣播他們的最新版本,他們將被懲罰,承擔通道中所有的資金並給與交易對方。由於自己的資金都押在自己的 RSMC 中,他們只能在承諾交易已被列入一個區塊後(在我們的例子中,1000 次確認),經過一定數量的確認後要求自己的資金。如果他們廣播的是自己的最新承諾交易,應該沒有撤銷交易替換之前可撤銷的交易,所以他們就能夠在一段時間(1000 次確認)後取回投入的資金。

By knowing who broadcast the Commitment Transaction and encumbering one’s own payouts to be locked up for a predefined period of time,both parties will be able to revoke the Commitment Transaction in the future.

通過瞭解誰廣播承諾交易,並阻礙自己的支出在提前確定好的的時間內被鎖定,雙方將能夠在未來撤銷承諾交易。

3.3.3 從通道兌換資金:合作交易方 Redeeming Funds from the Channel: Cooperative Counterparties

Either party may redeem the funds from the channel. However, the party that broadcasts the Commitment Transaction must wait for the predefined number of confirmations described in the RSMC. The counterparty which did not broadcast the Commitment Transaction may redeem the funds immediately.

任何一方都可以從通道贖回資金。然而,廣播承諾交易的一方必須等待在 RSMC 描述的提前確定好的交易數量。沒有廣播的承諾交易的交易對方可以立即贖回資金。

For example, if the Funding Transaction is committed with 1 BTC (half to each counterparty) and Bob broadcasts the most recent Commitment Transaction, C1b, he must wait 1000 confirmations to receive his 0.5 BTC, while Alice can spend 0.5 BTC. For Alice, this transaction is fully closed if Alice agrees that Bob broadcast the correct Commitment Transaction (C1b).

例如,如果資金交易承諾 1 BTC(每個交易對方一半),並且 Bob 廣播最新的承諾交易 C1b,他必須等 1000 次確認才能得到他的 0.5 BTC,Alice 可以花費 0.5 BTC。對於 Alice,本次交 易是完全封閉的,如果 Alice 同意 Bob 廣播的承諾交易(C1b)是正確的。

Figure 5: When Bob broadcasts C1b, Alice can immediately redeem her portion. Bob must wait 1000 confirmations. When the block is immediately broadcast, it is in this state. Transactions in green are transactions which are committed into the blockchain.

圖 5:當 Bob 廣播 C1b 時,Alice 可以立即贖回她的部分。Bob 必須等到 1000 次確認。當區塊被立即廣播,它是在該狀態下。綠色交易是它們提交到區塊鏈的交易。

After the Commitment Transaction has been in the blockchain for 1000 blocks, Bob can then broadcast the Revocable Delivery transaction. He must wait 1000 blocks to prove he has not revoked this Commitment Transaction (C1b). After 1000 blocks, the Revocable Delivery transaction will be able to be included in a block. If a party attempt to include the Revocable Delivery transaction in a block before 1000 confirmations, the transaction will be invalid up until after 1000 confirmations have passed (at which point it will become valid if the output has not yet been redeemed).

承諾交易已經在區塊鏈1000 區塊之後,Bob 就可以廣播可撤銷的交付交易。他必須等到 1000 區塊,以證明他並沒有撤銷該承諾交易(C1b)。1000 區塊後,可撤銷的交付交易將能夠被包括在一個區塊中。如果一方企圖包括在 1000 次確認之前將可撤銷的交付交易納入區塊,1000 次確認後該交易將是無效的(如果輸出尚未贖回,此時它就會成為有效的)。

Figure 6: Alice agrees that Bob broadcast the correct Commitment Transaction and 1000 confirmations have passed. Bob then is able to broadcast the Revocable Delivery (RD1b) transaction on the blockchain.

圖 6:Alice 同意,Bob 廣播正確的承諾交易並且 1000 次確認已經過去了。Bob 能夠在 區塊鏈上廣播可撤銷交付交易(RD1b)。

After Bob broadcasts the Revocable Delivery transaction, the channel is fully closed for both Alice and Bob, everyone has received the funds which they both agree are the current balance they each own in the channel.

Bob 廣播可撤銷交貨的交易後,對於 Alice 和 Bob,該通道完全關閉,每個人都收到了資金,他們都同意在當前餘額下,他們在通道內分別擁有的資金。

If it was instead Alice who broadcast the Commitment Transaction (C1a), she is the one who must wait 1000 confirmations instead of Bob.

如果是 Alice 廣播承諾交易(C1a),她必須等到 1000 次確認,而不是Bob。

3.3.4 創建一個新的交易承諾,並撤銷先前的承諾 Creating a new Commitment Transaction and Revoking Prior Commitments

While each party may close out the most recent Commitment Transaction at any time, they may also elect to create a new Commitment Transaction and invalidate the old one.

雖然任何一方都可以在任何時候收回最近交易承諾,他們也可以選擇創建一個新的承諾交易並且使舊的交易無效。

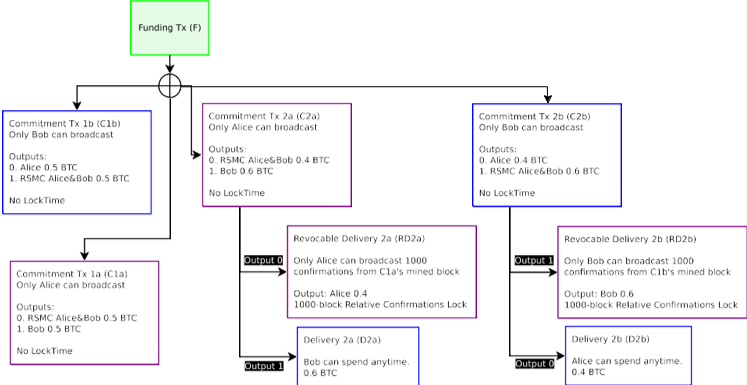

Suppose Alice and Bob now want to update their current balances from 0.5 BTC each refunded to 0.6 BTC for Bob and 0.4 BTC for Alice.When they both agree to do so, they generate a new pair of Commitment Transactions.

假設 Alice 和 Bob 現在要更新每人 0.5 BTC 的餘額,並且退還 0.6 BTC 給 Bob 和 0.4 BTC 給 Alice。當他們都同意這樣做,它們產生了一對新承諾交易。

Figure 7: Four possible transactions can exist, a pair with the old commitments, and another pair with the new commitments. Each party inside the channel can only broadcast half of the total commitments (two each). There is no explicit enforcement preventing any particular Commitment being broadcast other than penalty spends, as they are all valid unbroadcasted spends. The Revocable Commitment still exists with the C1a/C1b pair, but are not displayed for brevity.

圖 7:四種可能的交易可以存在,一對舊的承諾,另一對新的承諾。通道內每一方只能廣播一半的承諾。沒有明確的執行防止任何特定的承諾被廣播而不是懲罰花費,因為它們都是有效的未廣播的花費。可撤銷的承諾仍與 C1a / C1b 成對存在,但不顯示簡短。

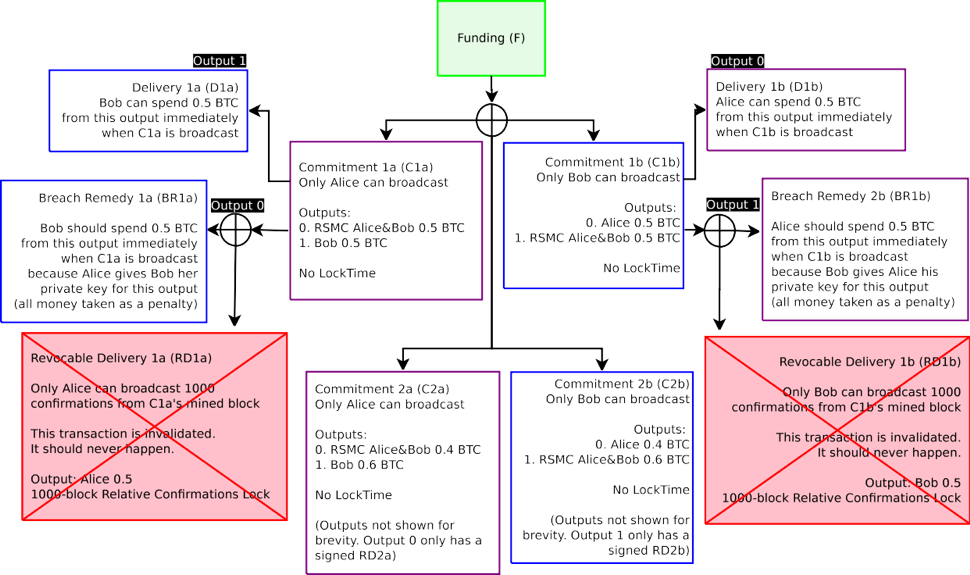

When a new pair of Commitment Transactions (C2a/C2b) is agreed upon, both parties will sign and exchange signatures for the new Commitment Transaction, then invalidate the old Commitment Transaction. This invalidation occurs by having both parties sign a Breach Remedy Transaction (BR1), which supersedes the Revocable Delivery Transaction (RD1). Each party hands to the other a half-signed revocation (BR1) from their own Revocable Delivery (RD1), which is a spend from the Commitment Transaction. The Breach Remedy Transaction will send all coins to the counterparty within the current balance of the channel. For example, if Alice and Bob both generate a new pair of Commitment Transactions (C2a/C2b) and invalidate prior commitments (C1a/C1b), and later Bob incorrectly broadcasts C1b on the blockchain, Alice can take all of Bob’s money from the channel. Alice can do this because Bob has proved to Alice via penalty that he will never broadcast C1b, since the moment he broadcasts C1b, Alice is able to take all of Bob’s money in the channel. In effect, by constructing a Breach Remedy transaction for the counterparty, one has attested that one will not be broadcasting any prior commitments. The counterparty can accept this, because they will get all the money in the channel when this agreement is violated.

當一個新的對交易的承諾(C2A / C2b)達成一致,雙方將簽署並交換新承諾交易的簽名,然後舊的承諾交易失效。這種失效通過讓雙方簽署違約補救交易(BR1)發生,它取代了撤銷交付交易(RD1)。每一方從自己的撤銷交付(RD1)發送給另一方的簽訂一半的撤銷交易(BR1),這是承諾交易的花費。違約補救交易就會把通道現有餘額中所有的現金給對方。例如,如果 Alice 和 Bob 都產生了一對新承諾交易(C2A / C2b)和失效的舊的承諾(C1a / C1b),後來 Bob 在區塊鏈不正確的廣播 C1b,Alice 可以拿走通道中 Bob 所有的錢。 Alice 能做到這一點,因為 Bob 已經通過懲罰向 Alice 證明,他將永遠不會廣播 C1b,因為他廣播 C1b 的那一刻,Alice 可以拿走通道中 Bob 所有的錢。事實上,通過為對方構建違約補救交易,一方已經證明,不會廣播任何事先的承諾。對方可以接受這一點,因為若該協議被違反,他們將得到通道中所有的錢。

Figure 8: When C2a and C2b exist, both parties exchange Breach Remedy transactions. Both parties now have explicit economic incentive to avoid broadcasting old Commitment Transactions (C1a/C1b). If either party wishes to close out the channel, they will only use C2a (Alice) or C2b (Bob). If Alice broadcasts C1a, all her money will go to Bob. If Bob broadcasts C1b, all his money will go to Alice. See previous figure for C2a/C2b outputs.

圖 8:當 C2A 和 C2B 存在,雙方交換違約補救交易。雙方現在都有明確的經濟激勵,避免廣播舊的承諾交易(C1a / C1b)。如一方要求關閉通道,他們將只使用 C2A(Alice)或 C2b 上(BOB)。如果 Alice 廣播 C1a,所有的錢都會給 Bob。如果 Bob 廣播 C1b,所有的錢都會給 Alice。C2A / C2b 的輸出請參閱前面的數位。

Due to this fact, one will likely delete all prior Commitment Transactions when a Breach Remedy Transaction has been passed to the counterparty. If one broadcasts an incorrect (deprecated and invalidated Commitment Transaction), all the money will go to one’s counterparty. For example, if Bob broadcasts C1b, so long as Alice watches the blockchain within the predefined number of blocks (in this case, 1000 blocks), Alice will be able to take all the money in this channel by broadcasting RD1b. Even if the present balance of the Commitment state (C2a/C2b) is 0.4 BTC to Alice and 0.6 BTC to Bob, because Bob violated the terms of the contract, all the money goes to Alice as a penalty. Functionally, the Revocable Transaction acts as a proof to the blockchain that Bob has violated the terms in the channel and this is programatically adjudicated by the blockchain.

由於這一事實,當違約補救交易已經交給交易對方時,人們可能會刪除所有先前的承諾交易。如果一方廣播不正確(過時的,無效的承諾交易),所有的錢都會給對方。例如,如果 Bob 廣播 C1b,只要 Alice 在事先定好的區塊數量範圍內觀察區塊鏈(在此情況下,1000 區 塊),Alice 將能夠通過廣播 RD1b 得到在這個通道的所有的錢。即使當前餘額的承諾狀態 (C2A / C2b)為 0.4 BTC 給 Alice 和 0.6 BTC 給 Bob,因為 Bob 違反了合約條款,作為懲罰,所有的錢給 Alice。在功能上,可撤銷交易作為一個區塊鏈上的證明,證明 Bob 違反渠道中的條款,並且這是由區塊鏈程式設計判定的。

Figure 9: Transactions in green are committed to the blockchain. Bob incorrectly broadcasts C1b (only Bob is able to broadcast C1b/C2b). Because both agreed that the current state is the C2a/C2b Commitment pair, and have attested to each party that old commitments are invalidated via Breach Remedy Transactions, Alice is able to broadcast BR1b and take all the money in the channel, provided she does it within 1000 blocks after C1b is broadcast.

圖 9:綠色代表被提交到區塊鏈上的交易。Bob 錯誤得廣播 C1b(只有 Bob 能夠廣播 C1b / C2b)。由於雙方都同意目前的狀態是 C2A / C2b 承諾對,並且已經通過違約補救交易證明了舊的承諾是無效的,Alice 能夠廣播 BR1b,並得到通道中所有的錢,只要她在 C1b 廣播 1000 區塊以後來執行。

However, if Alice does not broadcast BR1b within 1000 blocks, Bob may be able to steal some money, since his Revocable Delivery Transaction (RD1b) becomes valid after 1000 blocks. When an incorrect Commitment Transaction is broadcast, only the Breach Remedy Transaction can be broadcast for 1000 blocks (or whatever number of confirmations both parties agree to). After 1000 block confirmations, both the Breach Remedy (BR1b) and Revocable Delivery Transactions (RD1b) are able to be broadcast at any time. Breach Remedy transactions only have exclusivity within this predefined time period, and any time after of that is functionally an expiration of the statute of limitations —according to Bitcoin blockchain consensus, the time for dispute has ended.

但是,如果 Alice 不在 C1b 廣播 1000 區塊以後廣播 BR1b,Bob 也許能偷一些錢,因為他的撤銷交付交易(RD1b)在 1000 區塊後有效。當一個不正確的交易承諾被廣播,只有違約補救交易可廣播 1000 區塊(或其他的雙方同意的確認數量)。經過 1000 次確認,無論是違約補救措施(BR1b)還是可撤銷的交付交易(RD1b)能夠在任何時間廣播。違約補救交易只有在這個提前定義的時間段內具有排他性,之後的任何時間在功能上受到限制-根據比特幣區塊鏈共識,爭論的時間已經結束。

For this reason, one should periodically monitor the blockchain to see if one’s counterparty has broadcast an invalidated Commitment Transaction, or delegate a third party to do so. A third party can be delegated by only giving the Breach Remedy transaction to this third party. They can be incentivized to watch the blockchain broadcast such a transaction in the event of counterparty maliciousness by giving these third parties some fee in the output. Since the third party is only able to take action when the counterparty is acting maliciously, this third party does not have any power to force close of the channel.

為此,應定期監測區塊鏈,監控其對方是否廣播了無效的承諾交易,或委託協力廠商這樣做。只能通過向這個協力廠商提供違約補救交易來對其進行委託。協力廠商被激勵去監控區塊鏈中這樣的對方惡意廣播的交易,通過給這些協力廠商一些輸出中的手續費。由於第三人只能在對方惡意行為時採取行動,該協力廠商沒有任何強制關閉通道的權力。

3.3.5 創建可撤銷承諾交易流程 Process for Creating Revocable Commitment Transactions

To create revocable Commitment Transactions, it requires proper construction of the channel from the beginning, and only signing transactions which may be broadcast at any time in the future, while ensuring that one will not lose out due to uncooperative or malicious counterparties. This requires determining which public key to use for new commitments, as using SIGHASH NOINPUT requires using unique keys for each Commitment Transaction RSMC (and HTLC) output. We use P to designate pubkeys and K to designate the corresponding private key used to sign.

要創建可撤銷承諾交易,首先它需要正確的結構通道,並且僅僅簽訂可能在未來任何時間公布的交易,同時確保一方不會因不合作或惡意的對方而吃虧。這需要確定新的承諾要使用的公開金鑰,如使用 SIGHASH NOINPUT 要求每一個承諾交易 RSMC(和 HTLC)輸出使用特殊 鑰。我們用 P 來指定公開金鑰,K 來指定用於簽署的相應的私密金鑰。

When generating the first Commitment Transaction, Alice and Bob agree to create a multisig output from a Funding Transaction with a single multisig(PAliceF , PBobF ) output, funded with 0.5 BTC from Alice and Bob for a total of 1 BTC. This output is a Pay to Script Hash16 transaction, which requires both Alice and Bob to both agree to spend from the Funding Transaction. They do not yet make the Funding Transaction (F) spendable. Additionally, PAliceF and PBobF are only used for the Funding Transaction, they are not used for anything else.

當生成第一個承諾交易時,Alice 和 Bob 同意從一個資金交易一具有單一 multisig(PAliceF,PBobF)輸出中創建一個 multisig 輸出,提供來自 Alice 和 Bob 各 0.5 BTC,共 1 BTC 的資金。該輸出是一種給雜湊腳本16交易的付費,這需要雙方 Alice 和 Bob 同意從交易資金花費。他們還沒有使資金交易(F)可支配。此外,PAliceF 和 PBobF 僅用於資金交易,它們不用於其他任何東西。

Since the Delivery transaction is just a P2PKH output (bitcoin addresses beginning with 1) or P2SH transaction (commonly recognized as addresses beginning with the 3) which the counterparties designate beforehand, this can be generated as an output of PAliceD and PBobD . For simplicity, these output addresses will remain the same throughout the channel, since its funds are fully controlled by its designated recipient after the Commitment Transaction enters the blockchain. If desired, but not necessary, both parties may update and change PAliceD and PBobD for future Commitment Transactions.

由於交付交易僅僅是一個 P2PKH 輸出(比特幣地址從 1 開始)或 P2SH 交易(通常認為地址從 3 開始),這需要對方事先指定,這可以由 PAliceD 和 PBobD 的輸出生成。簡單起見,這些輸出地址將在整個通道過程保持不變,因為其資金是由它的指定接收方的承諾交易進入區塊鏈後完全控制。如果需要,但不是必要的話,雙方可以為未來的承諾交易更新改變 PAliceD 和 PBobD。

Both parties exchange pubkeys they intend to use for the RSMC (and HTLC described in future sections) for the Commitment Transaction. Each set of Commitment Transactions use their own public keys and are not ever reused. Both parties may already know all future pubkeys by using a BIP 003217 HD Wallet construction by exchanging Master Public Keys during channel construction. If they wish to generate a new Commitment Transaction pair C2a/C2b, they use multisig(PAliceRSMC2, PBobRSMC2) for the RSMC output.

雙方交換他們打算為承諾交易的 RSMC(和在以後的章節描述的 HTLC)使用的公開金鑰。每套承諾交易用自己的公開金鑰並且永遠不重複使用。雙方可能已經知道未來所有的公開金鑰,通過使用 BIP 0032 17 HD 錢包結構通道過程中交換主公共金鑰。如果他們希望生成一個新的承諾交易對 C2A / C2b,他們為 RSMC 輸出使用 multisig(PAliceRSMC2,PBobRSMC2)。

After both parties know the output values from the Commitment Transactions, both parties create the pair of Commitment Transactions, e.g. C2a/C2b, but do not exchange signatures for the Commitment Transactions. They both sign the Revocable Delivery transaction (RD2a/RD2b) and exchange the signatures. Bob signs RD1a and gives it to Alice (using KBobRSMC2), while Alice signs RD1b and gives it to Bob (using KAliceRSMC2).

雙方都知道承諾交易的輸出值之後,雙方建立了交易承諾對,如 C2A / C2b,但不為承諾交 易交換簽名。他們都簽署撤銷交付交易(RD2a / RD2b),並交換了簽名。Bob 簽署 RD1a並將其交給 Alice ( 使 用 KBobRSMC2 ) , Alice 簽 名 RD1b 並 將 其 交 給 Bob ( 使 用 KAliceRSMC2)。

When both parties have the Revocable Delivery transaction, they ex- change signatures for the Commitment Transactions. Bob signs C1a using KBobF and gives it to Alice, and Alice signs C1b using KAliceF and gives it to Bob.

當雙方都有可撤銷的交付交易時,它們為承諾交易交換簽名。Bob 使用 KBobF 簽署 C1a 並將其交給 Alice, Alice 使用 KAliceF 簽署 C1b 並將其交給 Bob。

At this point, the prior Commitment Transaction as well as the new Commitment Transaction can be broadcast; both C1a/C1b and C2a/C2b are valid. (Note that Commitments older than the prior Commitment are invalidated via penalties.) In order to invalidate C1a and C1b, both parties exchange Breach Remedy Transaction (BR1a/BR1b) signatures for the prior commitment C1a/C1b. Alice sends BR1a to Bob using KAliceRSMC1, and Bob sends BR1b to Alice using KBobRSMC1. When both Breach Remedy signatures have been exchanged, the channel state is now at the current Commitment C2a/C2b and the balances are now committed.

在這一點上,先前的承諾交易以及新的承諾交易能夠被廣播; C1a / C1b 和 C2A / C2b 上都是有效的。(注意,早於先前承諾的承諾通過處罰被判定為無效的。)為了使 C1a 和 C1b 無效,雙方為先前承諾 C1a / C1b 交換違約補救交易( BR1a / BR1b)簽名。 Alice 使用 KAliceRSMC1 發送 BR1a 給 Bob,Bob 使用 KBobRSMC1 發送 BR1b 給 Alice。當兩個違約補救簽名進行了交換,通道狀態是在當前承諾 C2A / C2b 上的餘額。

However, instead of disclosing the BR1a/BR1b signatures, it’s also possible to just disclose the private keys to the counterparty. This is more effective as described later in the key storage section. One can disclose the private keys used in one’s own Commitment Transaction. For example, if Bob wishes to invalidate C1b, he sends his private keys used in C1b to Alice (he does NOT disclose his keys used in C1a, as that would permit coin theft). Similarly, Alice discloses all her private key outputs in C1a to Bob to invalidate C1a.

然而,不公開 BR1a / BR1b 簽名,也可能只是透露私密金鑰給對方。在後面介紹的金鑰儲存部分會說明這樣是更有效率的。一方可以公開在自己的承諾交易中使用的私有金鑰。例如,如果 Bob 希望使 C1b 無效,他將他用於 C1b 的私密金鑰發送給 Alice(他沒有透露他在 C1a 使用的密鑰,因為這將引起硬幣盜竊)。同樣,Alice 向 Bob 公開了她在 C1a 所有的私有金鑰來使 C1a 無效。

If Bob incorrectly broadcasts C1b, then because Alice has all the private keys used in the outputs of C1b, she can take the money. However, only Bob is able to broadcast C1b. To prevent this coin theft risk, Bob should destroy all old Commitment Transactions.

如果 Bob 沒有正確廣播 C1b,因為 Alice 有所有的 C1b 輸出使用的私密金鑰,她可以拿錢。然而,只有 Bob 能夠廣播 C1b。為了防止這種硬幣被盜風險,Bob 應該銷毀所有舊的承諾交易。

3.4 協同關閉通道 Cooperatively Closing Out a Channel

Both parties are able to send as many payments to their counterparty as they wish, as long as they have funds available in the channel, knowing that in the event of disagreements they can broadcast to the blockchain the current state at any time.

雙方都能夠按照自己的意願來發送任何數量的支付給他們的對方,只要他們在通道有可用資金,因為他們知道在意見分歧的情況下,他們可以在任何時間在區塊鏈上廣播當前的狀態。

In the vast majority of cases, all the outputs from the Funding Transaction will never be broadcast on the blockchain. They are just there in case the other party is non-cooperative, much like how a contract is rarely enforced in the courts. A proven ability for the contract to be enforced in a deterministic manner is sufficient incentive for both parties to act honestly.

在絕大多數情況下,從資金交易所有輸出將永遠不會在區塊鏈廣播。他們只是在對方不合作的情況下出現,很像一份在法庭上很少執行的合約。該合約被證明有能力以一個確定的方式來強制執行有效地激勵雙方誠實守信。

When either party wishes to close out a channel cooperatively, they will be able to do so by contacting the other party and spending from the Funding Transaction with an output of the most current Commitment Transaction directly with no script encumbering conditions. No further payments may occur in the channel.

當一方希望關閉通道,他們將能夠這樣做,通過與對方創建合約,從現有的承諾交易不通過腳本阻礙條件直接花費。在通道中沒有進一步的付款可能發生。

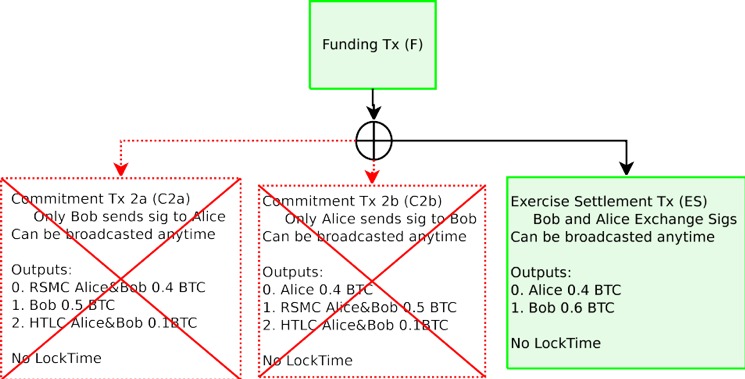

Figure 10: If both counterparties are cooperative, they take the balances in the current Commitment Transaction and spend from the Funding Transaction with a Exercise Settlement Transaction (ES). If the most recent Commitment Transaction gets broadcast instead, the payout (less fees) will be the same.

圖 10:如果雙方是合作的,他們採取當前交易承諾的餘額,並從有運用結算交易(ES)的資金交易中花費。如果最近的承諾交易被廣播,支出(較少手續費)將是相同的。

The purpose of closing out cooperatively is to reduce the number of transactions that occur on the blockchain and both parties will be able to receive their funds immediately (instead of one party waiting for the Revocation Delivery transaction to become valid).

合作關閉通道的目的是為了減少發生在區塊鏈上的交易數量,雙方將能夠立即收到他們的資金(而不是一方等待撤銷交付交易有效)。

Channels may remain in perpetuity until they decide to cooperatively close out the transaction, or when one party does not cooperate with another and the channel gets closed out and enforced on the blockchain.

通道可永久存在,直到他們決定合作關閉交易,或當一方不與另一方相互合作,在區塊鏈上執行關閉通道。

3.5 雙向通道的啟示與總結 Bidirectional Channel Implications and Summary

By ensuring channels can update only with the consent of both parties, it is possible to construct channels which perpetually exist in the blockchain. Both parties can update the balance inside the channel with whatever output balances they wish, so long as it’s equal or less than the total funds committed inside the Funding Transaction; balances can move in both directions. If one party becomes malicious, either party may immediately close out the channel and broadcast the most current state to the blockchain. By using a fidelity bond construction (Revocable Delivery Transactions), if a party violates the terms of the channel, the funds will be sent to the counterparty, provided the proof of violation (Breach Remedy Transaction) is entered into the blockchain in a timely manner. If both parties are cooperative, the channel can remain open indefinitely, possibly for many years.

通過確保通道只能在雙方當事人的同意的情況下得到更新,就可以構建永遠存在於區塊鏈上的通道。雙方可以在通道內以他們所希望的輸出更新餘額,只要它是等於或小於承諾資金交易內的資金總額;餘額可以在兩個方向上移動。如果一方是惡意的,任何一方都可以立即關閉通道並且廣播最新狀態到區塊鏈。通過使用網路保真債券建築(撤銷交付交易),如果一方當事人違反的通道的條款,資金將被發送給對方,只要違反(違約補救交易)的證明及時進入區塊鏈。如果雙方是合作,通道可以保持無限期地打開,可能很多年。

This type of construction is only possible because adjudication occurs programatically over the blockchain as part of the Bitcoin consensus, so one does not need to trust the other party. As a result, one’s channel counterparty does not possess full custody or control of the funds.

這種類型的結構是唯一可能的,因為審判程式設計作為比特幣共識的一部分發生在 區塊鏈上,所以人們並不需要信任對方。這樣一來,一方的通道對方不能充分的監管或控制資金。

4 雜湊 Timelock 合約(HTLC) Hashed Timelock Contract (HTLC)

A bidirectional payment channel only permits secure transfer of funds inside a channel. To be able to construct secure transfers using a network of channels across multiple hops to the final destination requires an additional construction, a Hashed Timelock Contract (HTLC).

雙向支付通道只允許資金在通道內安全轉移。為了能夠使用跨多個中繼段通向網路最終目的地得網路通道建立安全傳輸,需要一個額外的結構,雜湊 Timelock 合約(HTLC)。

The purpose of an HTLC is to allow for global state across multiple nodes via hashes. This global state is ensured by time commitments and time-based unencumbering of resources via disclosure of preimages. Transactional “locking” occurs globally via commitments, at any point in time a single participant is responsible for disclosing to the next participant whether they have knowledge of the preimage R. This construction does not require custodial trust in one’s channel counterparty, nor any other participant in the network.

一個 HTLC 的目的是通過雜湊允許在多個節點的全域狀態。這種全域狀態通過披露原像由承諾的時間和以時間為基準的無阻礙資源來確保。交易“鎖定”通過承諾發生在全域,在特定時間,一個參與者負責披露給下一參與者他們是否掌握原像 R 的資訊。這種結構並不要求通道中對方的保管信託,在網路中也沒有任何其他參與者。

In order to achieve this, an HTLC must be able to create certain transactions which are only valid after a certain date, using nLockTime, as well as information disclosure to one’s channel counterparty. Additionally, this data must be revocable, as one must be able to undo an HTLC.

為了達到這個,一個 HTLC 必須能夠創建只在特定日期後有效的某些交易,使用 nLockTime,以及公開給通道對方的資訊。此外,該資料必須是可撤銷的,因為一個人必須能夠撤銷 HTLC。

An HTLC is also a channel contract with one’s counterparty which is enforcible via the blockchain. The counterparties in a channel agree to the following terms for a Hashed Timelock Contract:

- If Bob can produce to Alice an unknown 20-byte random input data R from a known hash H, within three days, then Alice will settle the contract by paying Bob 0.1 BTC.

- If three days have elapsed, then the above clause is null and void and the clearing process is invalidated, both parties must not attempt to settle and claim payment after three days.

- Either party may (and should) pay out according to the terms of this contract in any method of the participants choosing and close out this contract early so long as both participants in this contract agree.

- Violation of the above terms will incur a maximum penalty of the funds locked up in this contract, to be paid to the non-violating counterparty as a fidelity bond.

HTLC 也是一個可在區塊鏈上執行的與對方簽訂的的通道合約。通道中對方同意雜湊 Timelock 合約的以下條款:

- 如果 Bob 可以為 Alice 從已知的雜湊值 H 中產生未知的 20 Byte的的隨機輸入資料 R,在三天之內,Alice 將通過支付 Bob0.1 BTC 結算合約。

- 如果三天已經過去了,那麼上述條款無效,清算過程也無效,雙方三天后都不能結算和要求付款。

- 任何一方都可以(也應該)按照本合約的條款以參加者選擇的任何方法支付並且早期關閉此合約,只要這一合約中的兩個參與者同意。

- 違反上述條款將導致最大的懲罰,資金被鎖在合約中,被支付給作為保真債券資金的對方。

For clarity of examples, we use days for HTLCs and block height for RSMCs. In reality, the HTLC should also be defined as a block height (e.g. 3 days is equivalent to 432 blocks).

為了闡明例子,我們在 HTLCs 中使用天數,在 RSMC 使用區塊高度。在現實中,HTLC 也應該被定義為一個區塊高度(例如 3 天相當於 432 區塊)。

In effect, one desires to construct a payment which is contingent upon knowledge of R by the recipient within a certain timeframe. After this timeframe, the funds are refunded back to the sender. Similar to RSMCs, these contract terms are programatically enforced on the Bitoin blockchain and do not require trust in the counterparty to adhere to the contract terms, as all violations are penalized via unilaterally enforced fidelity bonds, which are constructed using penalty transactions spending from commitment states. If Bob knows R within three days, then he can redeem the funds by broadcasting a transaction; Alice is unable to withhold the funds in any way, because the script returns as valid when the transaction is spent on the Bitcoin blockchain.

事實上,人們希望建立一個支付,這個支付取決於收件人在一定的時間內對 R 的資訊。在此期限後,該資金退還給寄件者。 類似于 RSMC,這些合約條款是在比特幣區塊鏈上強制性程式設計的,不需要對方服從合約條款的信任,因為所有的違反條款的行為都通過單方面強制網路保真債券資金受到懲罰,承諾交易投入手續費設置處罰。如果 Bob 在三天內知道 R,那麼他就可以廣播交易以贖回資金;Alice 是無法以任何方式截留資金的,因為當比特幣區塊鏈上發生了交易,腳本有效地返回。

An HTLC is an additional output in a Commitment Transaction with a unique output script:

OP IF

OP HASH160 <Hash160 (R)> OP EQUALVERIFY

2 <Alice 2 > <Bob2> OP CHECKMULTISIG

OP ELSE

2 <Alice 1 > <Bob1> OP CHECKMULTISIG

OP ENDIF

一個 HTLC 是一個具有獨特的輸出腳本承諾交易的額外的輸出:

OP IF

OP HASH160 <Hash160 (R)> OP EQUALVERIFY

2 <Alice 2 > <Bob2> OP CHECKMULTISIG

OP ELSE

2 <Alice 1 > <Bob1> OP CHECKMULTISIG

OP ENDIF

Conceptually, this script has two possible paths spending from a single HTLC output. The first path (defined in the OP IF) sends funds to Bob if Bob can produce R. The second path is redeemed using a 3-day timelocked refund to Alice. The 3-day timelock is enforced using nLockTime from the spending transaction.

從概念上講,這個腳本從單一的 HTLC 輸出花費有兩種可能的路徑。在第一個路徑(定義為 OP IF)將資金發送給 Bob,如果 Bob 可以產生 R.。第二條路徑是被贖回,使用 3 天 timelocked 退款給 Alice。為期 3 天的 timelock 使用來自於消費交易的 nLockTime 執行。

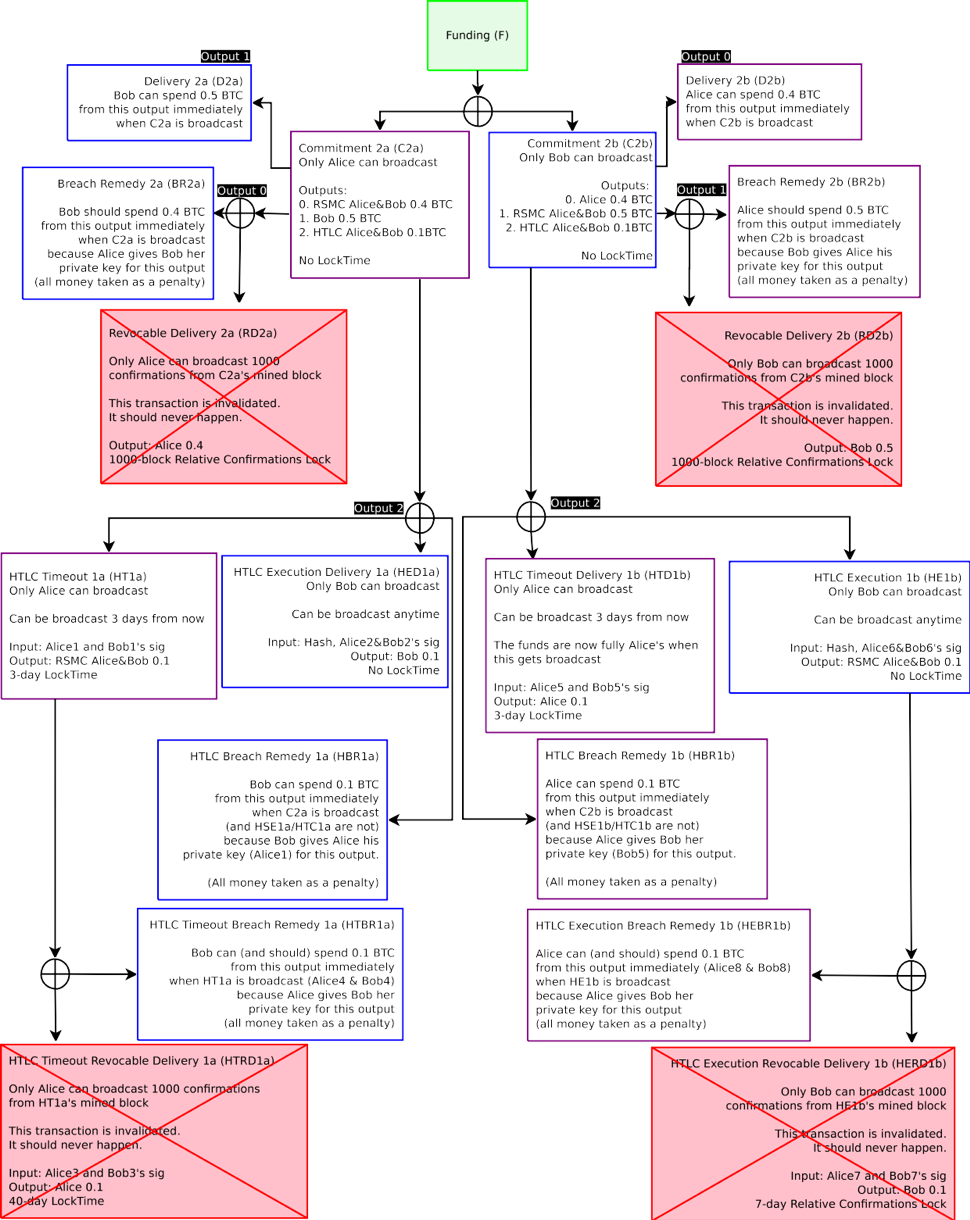

4.1 不可撤銷的 HTLC 結構 Non-revocable HTLC Construction

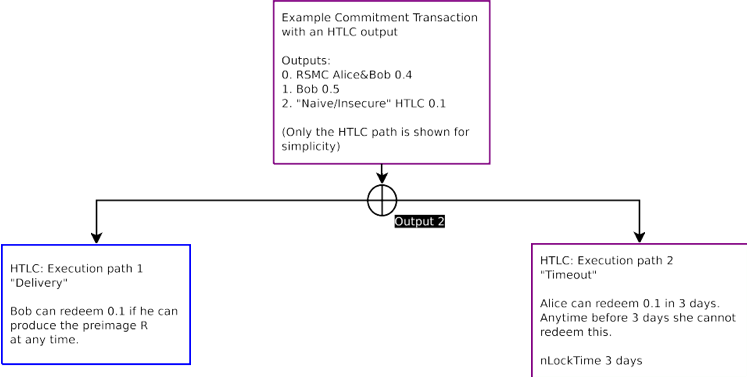

Figure 11: This is a non-functional naive implementation of an HTLC. Only the HTLC path from the Commitment Transaction is displayed. Note that there are two possible spends from an HTLC output. If Bob can produce the preimage R within 3 days and he can redeem path 1. After three days, Alice is able to broadcast path 2. When 3 days have elapsed either is valid. This model, however, doesn’t work with multiple Commitment Transactions.

圖 11:這是一個 HTLC 的非功能性前期執行。只有來自於承諾交易的 HTLC 路徑可以被顯示。注意有兩種可能的來自於 HTLC 輸出花費。如果 Bob 能在 3 天之內生產原像 R,他可以贖回路徑 1.三天后,Alice 能夠廣播路徑 2。當 3 天已過或者是有效的。然而,該模型中,這並不與多個承諾交易工作。

If R is produced within 3 days, then Bob can redeem the funds by broadcasting the “Delivery” transaction. A requirement for the “Delivery” transaction to be valid requires R to be included with the transaction. If R is not included, then the “Delivery” transaction is invalid. However, if 3 days have elapsed, the funds can be sent back to Alice by broadcasting transaction “Timeout”. When 3 days have elapsed and R has been disclosed, either transaction may be valid.

如果 R 是在 3 天之內產生的,那麼 Bob 可以通過廣播“交付”交易贖回資金。“交付”交易有效的一個要求是 R 被包含在交易內。若 R 不被包括,則“交付”交易無效。但是,如果 3 天內已過,資金可以通過廣播交易“Timeout”發回給 Alice。3 天后,R 已經被公開,任何交易可能是有效的。

It is within both parties individual responsibility to ensure that they can get their transaction into the blockchain in order to ensure the balances are correct. For Bob, in order to receive the funds, he must either broadcast the “Delivery” transaction on the Bitcoin blockchain, or otherwise settle with Alice (while cancelling the HTLC). For Alice, she must broadcast the “Timeout” 3 days from now to receive the refund, or cancel the HTLC entirely with Bob.

這是雙方個人範圍內的責任,以確保他們的交易進入區塊鏈,以保證餘額是正確的。對於 Bob,為了獲得資金,他必須要麼廣播比特幣區塊鏈的“交付”交易,或與 Alice 結算(同時取消 HTLC)。對於 Alice,她必須從即日起 3 天內廣播的“Timeout”交易,以收到退款,或與 Bob 完全取消 HTLC。

Yet this kind of simplistic construction has similar problems as an incorrect bidirectional payment channel construction. When an old Commitment Transaction gets broadcast, either party may attempt to steal funds as both paths may be valid after the fact. For example, if R gets disclosed 1 year later, and an incorrect Commitment Transaction gets broadcast, both paths are valid and are redeemable by either party; the contract is not yet enforcible on the blockchain. Closing out the HTLC is absolutely necessary, because in order for Alice to get her refund, she must terminate the contract and receive her refund. Otherwise, when Bob discovers R after 3 days have elapsed, he may be able to steal the funds which should be going to Alice. With uncooperative counterparties it’s not possible to terminate an HTLC without broadcasting it to the bitcoin blockchain as the uncooperative party is unwilling to create a new Commitment Transaction.

然而,這種簡單的結構也有類似於不正確的雙向支付通道結構的問題。當舊的承諾交易被公 布,任何一方都可以試圖竊取資金,因為在此事後,兩個路徑可能是有效的。例如,若 R 被公開 1 年以後,並且不正確的承諾交易被廣播,兩個路徑都有效並且可由任何一方贖回;合約還沒有在區塊鏈上被執行。關閉 HTLC 是絕對必要的,因為 Alice 為了得到退款,她必須終止合約,並接受她的退款。否則,當 Bob3 天后發現 R,他可能能夠竊取應給 Alice 的資金。對於不合作的對方,不可能在沒有把它廣播在區塊鏈時終止 HTLC,因為不合作的一方不願建立新的承諾交易。

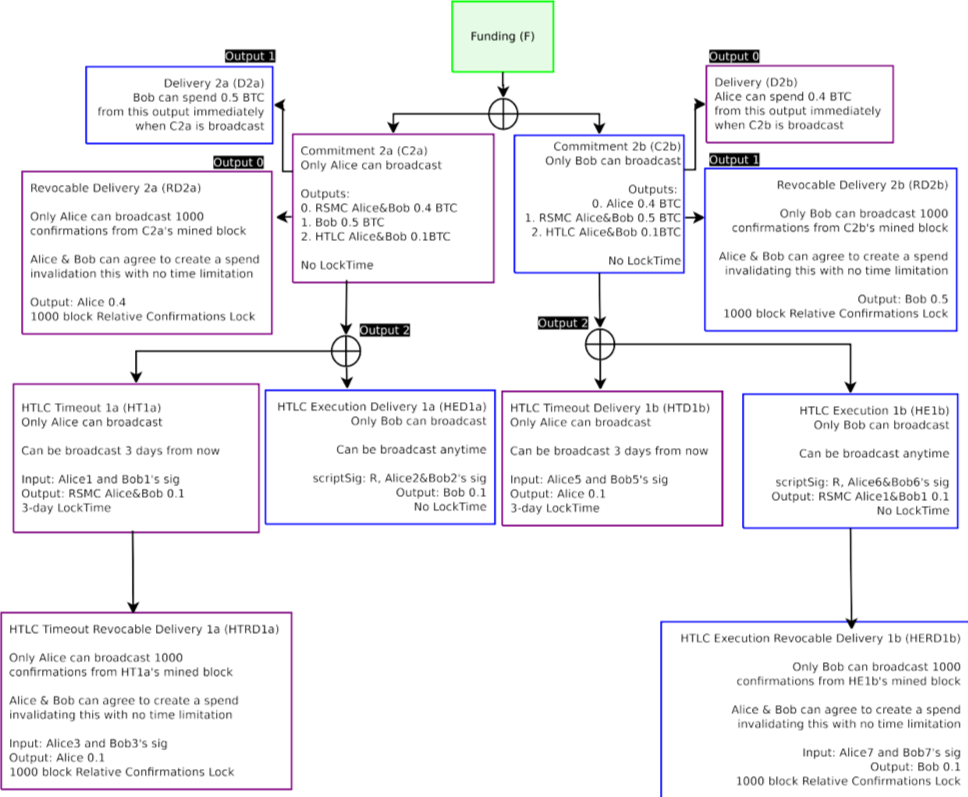

4.2 Off-chain 可撤銷 HTLC Off-chain Revocable HTLC

To be able to terminate this contract off-chain without a broadcast to the Bitcoin blockchain requires embedding RSMCs in the output, which will have a similar construction to the bidirectional channel.

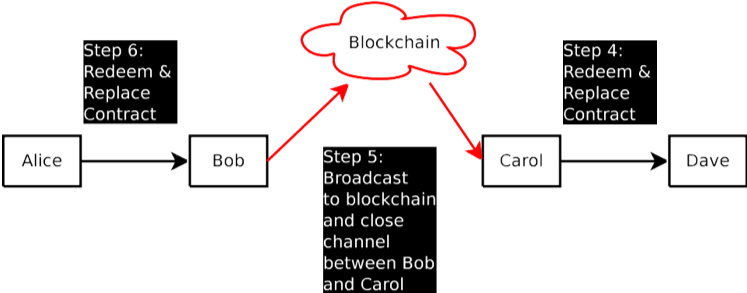

為了能夠在不廣播到比特幣區塊鏈情況下終止 Off-chain 合約,需要在輸出中嵌入 RSMCs,RSMCs 將與雙向通道有類似結構。